The billionaire’s money stopped showing up. Senior executives resigned left and right. Suppliers said they weren’t getting paid. You have no idea what a mess things are behind the scenes at the mysterious car startup Faraday Future.

For a year now observers in both the automotive and tech industries have wondered what kind of money the Chinese-backed auto startup Faraday Future really has, and how it could pull off its grandiose, world-beating plans. But all is not well there now.

Sources close to Faraday Future, including suppliers, contractors, current, prospective and ex-employees all spoke to Jalopnik over a number of weeks on conditions of anonymity and said the money has been M.I.A., the plans are absurd and the organization verges on the dysfunctional.

A year ago, things seemed very different. In late November of 2015, Faraday Future burst onto the scene with promises as big as its name was mysterious.

Staffed by prominent industry figures poached from companies like Tesla, Apple, Ferrari and BMW, FF made bold, unprecedented promises: an electric car that could not only drive itself but connect to its owner’s smartphone and learn from their daily habits to become the ultimate personalized vehicle. And if ownership didn’t suit their lifestyle, fine; the company was eager to expand into ride-sharing and autonomous fleet services.

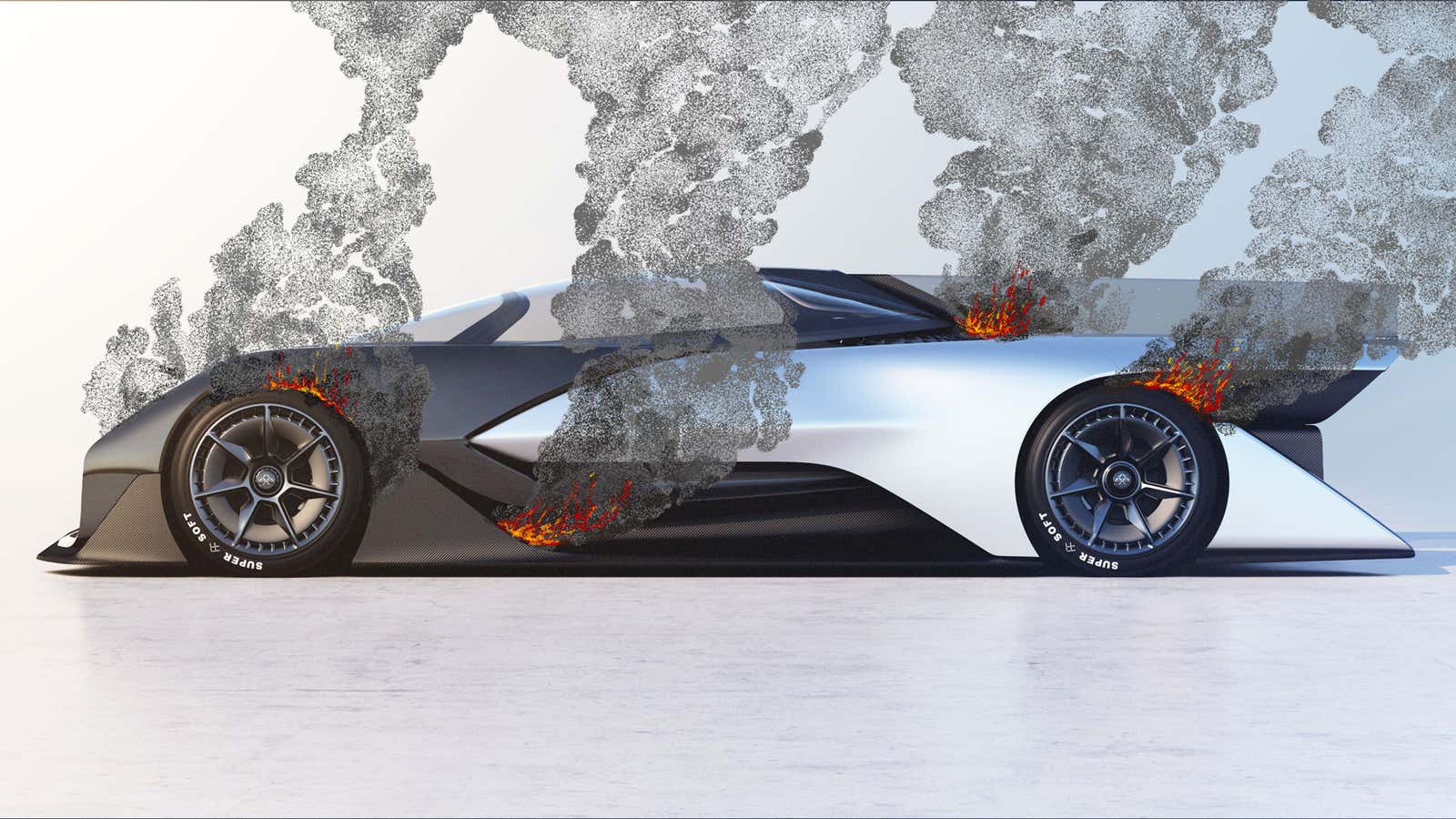

With a $1 billion facility in Nevada, the company promised production by 2017. Forget what you know about cars, the teaser videos proclaimed. A revolution is coming and we would see it at the CES trade show in Las Vegas. Everyone anticipated an actual car that could live up to these claims.

Then January and CES rolled around and the company revealed that yes, that wild rocket-looking supercar that leaked onto the internet via an app really was Faraday Future’s show car. But not its actual production car. That would come later, the company swore after an embarrassing debut that laid the hype and the buzzwords on thick but had seemingly little to back it up. In the meantime the company promised a “skateboard” modular electric platform that could be adapted to suit several different body styles.

But everything would be fine, right? After all, FF was getting $335 million in state tax incentives and abatements from Nevada for its plant, and it was sponsoring a Formula E team. And in the company’s own words, it would do for cars what the iPhone did for communications in 2007. And Faraday Future is funded by Jia Yueting, a tech mogul in China known for starting the country’s first paid video streaming service. It’s often nicknamed “The Netflix of China,” and it brought Jia the billions he needed to start a whole tech empire, selling everything from smartphones to TVs to cars.

What could go wrong?

That was in January. FF spent the next several months in the news over and over again, almost always for reasons no company wants to be in the news. There was the lag on payments to the factory’s construction company, the senior staffers jumping ship, the confusing debut of a seemingly competing car from the company helmed by its principal backer, the lawsuits from a supplier and a landlord who said they weren’t getting paid, the work stoppage on the factory, the state officials in Nevada who said Jia didn’t have as much money as he claimed (something that Jia denied in a haters-are-my-motivators statement), and the fact that leaders in that state copped to never really knowing much about FF’s financials before approving that incentive package.

Now, when industry observers and consumers—eager to see what’s next in car technology as our notions of mobility start to change, and wonder what this infusion of mysterious Chinese money really means—look to Faraday Future, they wonder what the hell is really going on. And whether the company can actually deliver on any of its hype in the coming year.

Faraday Future declined to comment, and declined to comment on behalf of Jia, saying he is merely “an investor.” Its so-called strategic partner, LeEco, Jia’s flagship Chinese tech business that is also seeking to build an electric car of its own has not yet responded to requests for comment.

The Supplier Lawsuit

The story of what happened to Faraday Future must start with suppliers—the third-party companies who make various parts and components for cars—not getting paid.

Faraday Future is now getting sued by the supplier that makes its seats, a company called Futuris, over allegedly unpaid bills, as BuzzFeed News broke Thursday. Futuris says that Faraday Future owes no less than $10 million, a stark $7 million of which is more than 30 days overdue.

The suit claims that Faraday Future was paying Futuris monthly for developing the seats for Faraday Future’s car, the Beta. Over the summer, FF’s payments just stopped, the lawsuit alleges.

According to the complaint, at first Futuris was asking Faraday Future if its work was satisfactory, and if they were going to be sending back payments. Each time Futuris asked, Faraday would say that Futuris’ work was satisfactory and that money was on the way from China. But at no point did Futuris get its money, all the way through the end of November of this year, the lawsuit alleges. Ultimately, the suit said Futuris asked Faraday Future again where the money was. Faraday Future’s purchasing manager explained that the money was still tied up in China and Futuris would be paid in full as soon as the money came through. Futuris, as it alleges in the suit, still has not been paid.

Futuris waited two weeks after its last communique with Faraday Future, then filed the suit we see now. [Update Friday 6:35 p.m. ET: The case, mysteriously, has been dismissed according to According to Los Angeles County Superior Court records, on Wednesday. The reasons for this are unknown, and a lawyer for Futuris declined to comment.]

This was not an isolated issue. Internal corporate documents from July seen by Jalopnik describe overdue bills in the tens of millions of dollars to several more suppliers in addition to Futuris. And sources who spoke to us indicate suppliers are still not getting paid. (Those suppliers have not provided any official confirmation or denial in any of Jalopnik’s requests for comment.)

These partners ceased business with Faraday Future, our sources explain, and it is unclear how the company can keep going without them.

Faraday Future does not have an operating factory at the moment. With missing key suppliers and no factory, what does it have?

The Infamous Yahoo Land Deal

But we’re going to have to look to a single moment in Faraday Future’s history that illustrates better the even deeper issues within the company, and it’s one that at first seems fairly innocuous: back in June of this year, LeEco bought just under 50 acres of land from Yahoo in Santa Clara for $250 million.

Recall that LeEco is the Chinese tech giant owned by Jia Yueting, FF’s principal backer. Guess who guaranteed that land deal for LeEco? Faraday Future.

Now, this doesn’t make a lot of sense, because Faraday Future and LeEco are officially not the same company. That part is important.

Faraday Future is based out of the United States and got started before LeEco got into cars, while LeEco is based out of Beijing and started getting into cars after Faraday Future. The two companies say they are “strategic partners,” but it’s not clear what exactly divides them.

Faraday Future doesn’t even list a distinct CEO as one of its senior officers, and has never announced one; BuzzFeed News’ report says the company won’t even confirm it is looking for one. Particularly painful is news reported Thursday that Faraday Future was actually ordered to design LeEco’s first car at the expense of development at Faraday Future.

Just as well, Faraday Future employees said their company never got paid for the work, according to the story. At best, Faraday Future’s place in Jia Yueting’s auto empire seems to be that it has a more “American” face than LeEco, that it has more hype, and that it seems like it has its own money.

Again, that part is important.

Back in June, LeEco received a $140 million loan from a lending company called Mesa West to buy Yahoo’s Santa Clara land and put Faraday Future down as the guarantor for the loan, according to sources familiar with the deal speaking to Jalopnik under conditions of anonymity, and internal company documents.

Having a guarantor was good for LeEco, as it made the loan and thus the land purchase possible. Being the guarantor was very much an added risk for Faraday Future, because it was now on the hook if LeEco could not pay, the sources said.

Six top executives, ranging from heads of manufacturing to human resources, implored Jia to not use Faraday Future as a guarantor, according a signed letter dated to June 2016 and viewed by Jalopnik, noting that Faraday Future had enough problems of its own.

The letter explained that Faraday Future had a history of being late on payments to suppliers, with $30 million outstanding, $23 million of which was overdue at the time of the deal. The letter pleaded that at this time, behind on bills, Faraday Future forecasted another $445 million in payments over the next thirteen weeks. In essence, it was not in any condition to back a side project for LeEco.

The Yahoo land purchase begrudgingly went through after adjustments from FF’s top lawyer, enough to assuage fears from some key executives who were being asked to sign documents in connection with this deal. Without these changes these executives—who were not lawyers—feared they would go to jail, as seen in internal company emails. After that was over, however, Faraday Future hired outside accountants to go over the company’s books.

The $300 Million Question

This was not an extraordinary move. Sources close to the situation explained to Jalopnik that the financial team at Faraday Future thought that the books seemed fine when they themselves reviewed them. They were only looking to close the books to prep them for a larger financial firm’s overview—standard steps towards an eventual initial public offering on the stock market. But what the outside accountants discovered was troubling, our sources said.

The covenants of the loan from Mesa West included terms that required Faraday Future and LeEco to maintain a combined net worth of $120 million, and if the net worth fell below that number it would be in violation of the loan agreement and had 10 days to correct it. If FF’s net worth went below $90 million, it was automatically in default, according a source who has requested anonymity as well as an internal email sent between the company’s lawyers and finance officers.

Faraday Future was told by its outside accountants in July that it had $300 million in liabilities that it hadn’t recorded. Documents seen by Jalopnik, whose veracity was confirmed by another source with knowledge of the company’s affairs, indicate that nobody at FF—even its top accounting and financial officers—had any idea about how much liability it hadn’t even accounted for. One source had to tell his coworkers, the outside accountants indicated that the company didn’t have the roughly $100 million positive net worth it thought it had, but rather approximately negative $200 million.

I will briefly pause to say that this is insane. Finance, accounting and legal executives were arguing whether or not the company had a $300 million hole they didn’t even know was there.

And these were not irrelevant line items: these were agreements to pay suppliers for work, for tooling, for the very prototypes we see Faraday Future hyping in the news.

The issue was brought forward in July by executives to the then-director of accounting and administration at Faraday Future, Chaoying Deng, worried that now the company was not only in trouble in terms of funding on a very basic level, but also in violation of its loan agreement with Mesa West, according to documents seen by Jalopnik.

The response was bewildering, both to me and presumably to the six executives who quickly quit the company. Documents seen by Jalopnik show Faraday Future’s then-accounting and admin director denying that there was any problem at all. The issue of the $300 million was only partially true, she said; it was just the result of some accounting errors and late-filed documents. “My bad,” was the precise wording. And the financial requirement to Mesa West only needed to be fulfilled by LeEco and Faraday Future together. Everything was going to be fine.

This is a company that was behind on bills, planning on spending an order of magnitude more in the immediate future and still is behind on bills as alleged in the Futuris suit. Which is how six of Faraday Future’s top executives came to resign, the sources said. For months they had dealt with promises of money coming in from China.

Month after month, the money never arrived, but spending kept up. At a certain point, it became clear that those in charge of Faraday Future had no idea what they were doing.

With CES a month away, skepticism abounds more than ever. Eternal optimist Nevada’s Governor Sandoval issues a response on Thursday against naysayers, stating “the state and taxpayers are fully protected should Faraday not meet its $1 billion investment.”

The Man At The Top Who Wanted More

I wish I could say this in front of every sentence I write about Faraday Future, but from everything I’ve seen there is good and serious engineering work getting done at the company.

If anything, Faraday Future has too many people working on one of the most interesting cars we’ve seen in years, engineers crammed computer to computer, even on fold up-picnic tables as one anonymous interviewee told Jalopnik. All-electric, eyes on autonomy, with incredible performance and design. “There’s a lot of good people there,” one source noted. “That’s the worst part.”

But you can’t have this engineering side without a solid business to back it up, and the good work at Faraday Future seems like it has been constantly undone by the unrealistic demands of its top leadership and a money gulf across the Pacific.

Documents seen by Jalopnik reflect that finance executives repeatedly asked Jia for more money, money the company needed desperately to pay off its debts to suppliers. At each turn, these executives were turned away, told that money on its way from China, and to continue spending money and making new supplier commitments.

One top executive was asked to price out Jia’s wishlist for the business that included a dramatic, multi-billion dollar projected product plan. He presented the estimate to Jia at a meeting in China and came away with impression that the plans were—and this is perhaps the most forgiving assessment of Faraday Future’s plans given what others have told us—“almost delusional.”

But, like the suppliers, the executive was assured the money would come eventually.

If you have any information about Faraday Future, please email raphael at jalopnik dot com.