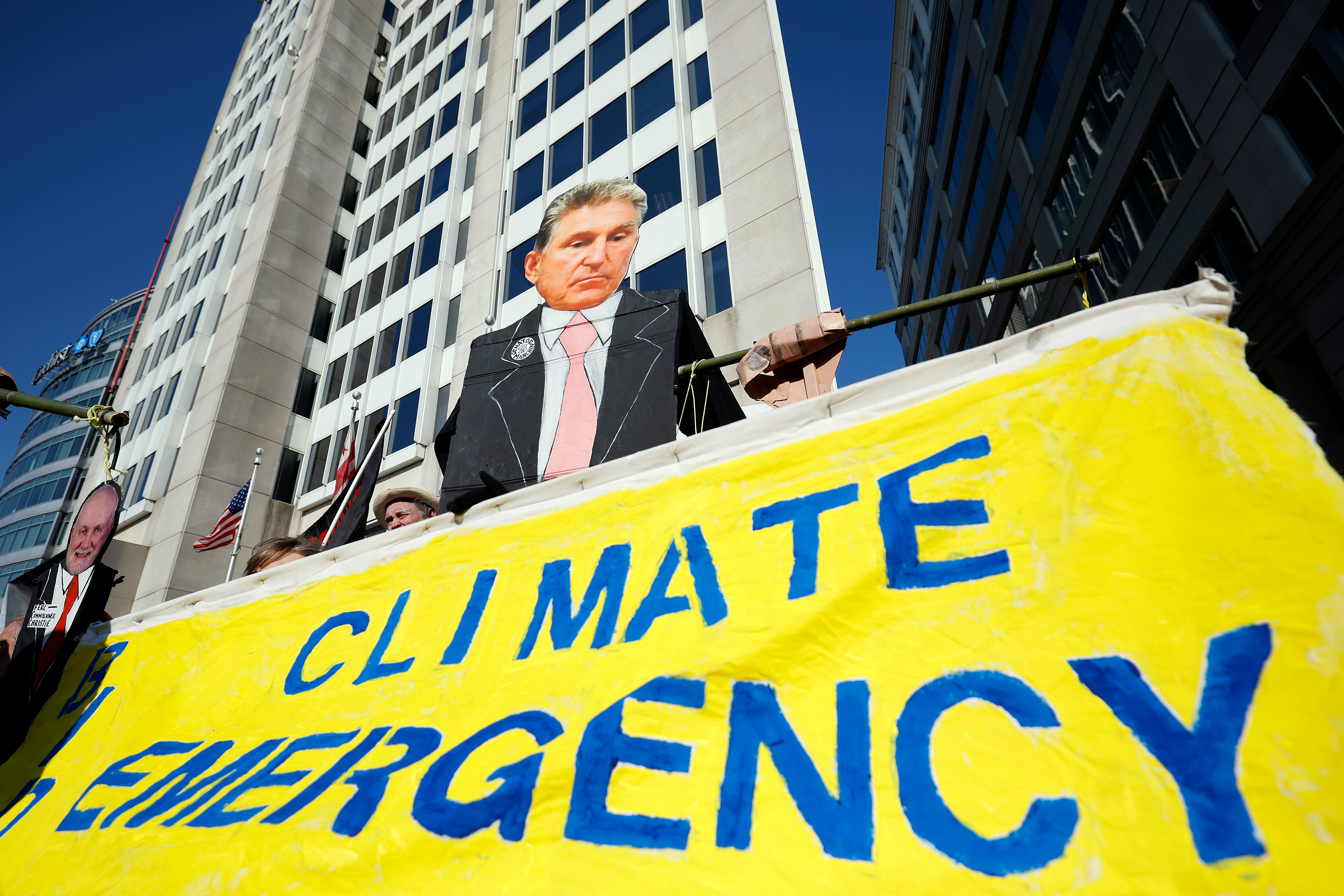

The Fossil Fuel Senator Wants EVs To Be More Expensive

Joe Manchin wants to remind the U.S. Treasury that federal EV Tax Credits are not about cheap EVs.

U.S. Senator Joe Manchin is expressing his displeasure with the U.S. Treasury Department again for its handling of the federal EV tax credits found in the Inflation Reduction Act. The architect of the latest cuts to the EV tax credits has taken exception, specifically, to Treasury's implementation of the provision labeled Section 30D, according to Automotive News, which could extend the full $7,500 tax credit to EVs that are not sourced from and assembled in the U.S.

Manchin is against the eligibility of partial or full tax credits for EVs that don't conform to the strict rules in the IRA. And Manchin is now arguing that the Treasury has misunderstood the point of the EV tax credits in the first place, which are not about making EVs cheaper to buy in the U.S., but are instead all about encouraging the ongoing development of an EV supply chain in the U.S., as Manchin explained in a strongly-worded letter his office sent to Treasury, per Automotive News:

Manchin, who chairs the Senate Energy and Natural Resources Committee, said proposed guidance released by Treasury in March "deviates from the will of Congress in at least three major respects," including its interpretation of the critical mineral requirement and free-trade agreement.

"My comment is simple: Follow the law," he wrote in an 11-page letter to Treasury, explaining that the tax credit's purpose is "no longer to promote the purchase and use of [EVs] ... but to promote reliable domestic supply chains for the critical minerals and battery components" needed to power them.

Basically, Manchin is suggesting that the IRA's strict domestic sourcing and production rules are there for a reason. These are, ostensibly, as stringent as they are so that carmakers and EV battery suppliers are forced to bolster the U.S.'s domestic supply chain, and make its EV production less dependent on so-called foreign entities of concern, which is diplomat-speak for China.

But, even putting aside Senator Joe Manchin's ties to the fossil fuel industry, which make his criticism suspect — given a vested interest in the continued use of fossil fuels — it's not like there's not a middle ground. Or perhaps a timeline that makes more EVs eligible for federal tax credits in the interim period during which the U.S. builds up its EV production capacity.

While domestic sourcing and production is, indeed, something worth aiming for in the near- to mid-term, building that out takes a long time and a lot of money. Manchin's current proposal makes EVs less accessible to many drivers in the U.S. by eliminating the incentives that could level the playing field between EVs and ICE-equipped vehicles. Or at the very least, attempting to do so by offering the full $7,500 federal EV tax credits to more fully-electric vehicles.

The irony is Manchin risks making EVs less likely to proliferate (due to their relatively high cost), and, therefore, risks a lower likelihood, or need, for OEMs to invest in the "reliable domestic supply chain" that Manchin claims to be after. It seems that Manchin is accidentally throwing out the baby with the bathwater here. Unless, of course, that was the point all along.