The Price Of A Barrel Of Oil Is Somehow Below $0 Because Economics Is Weird

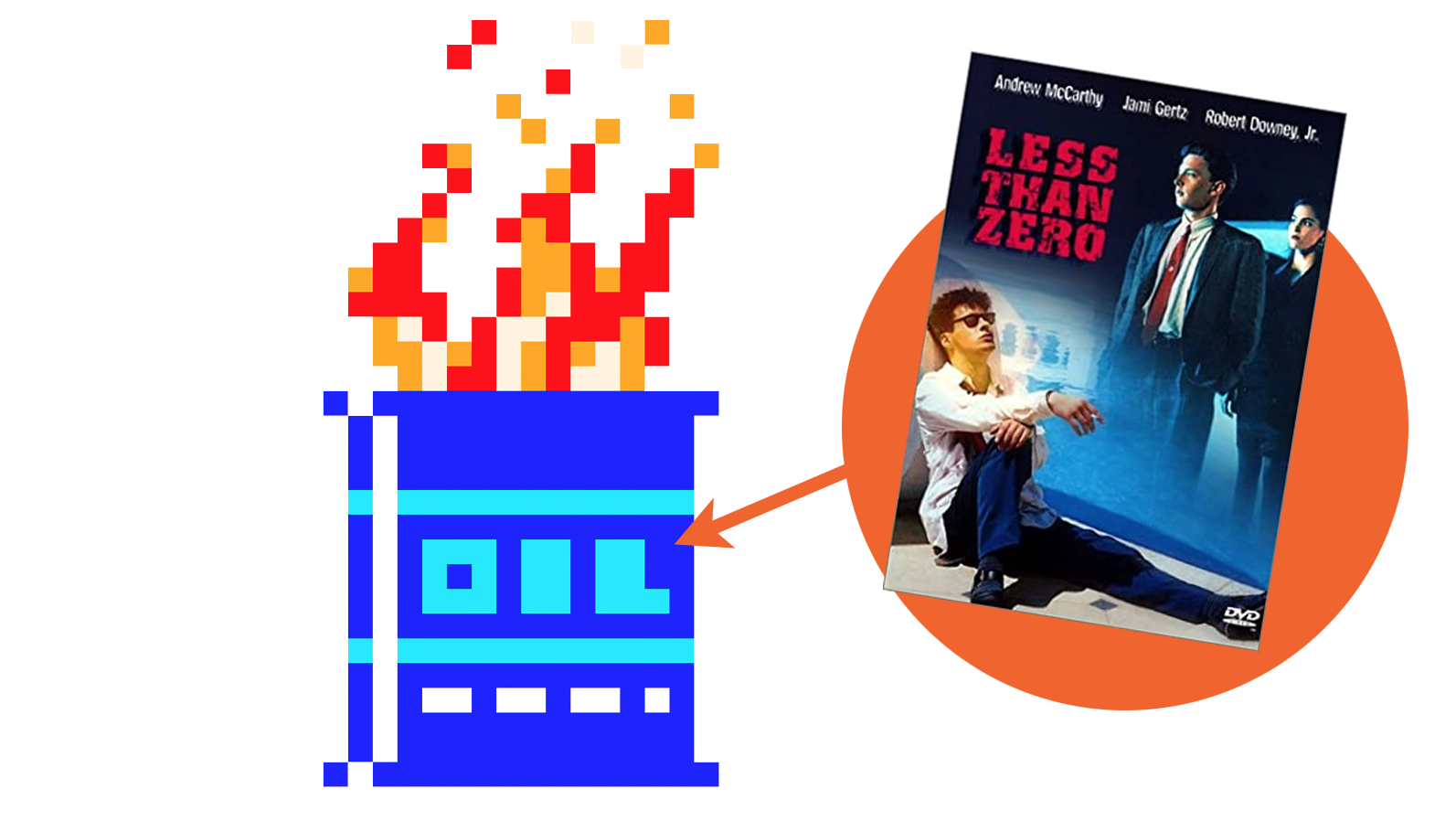

I'm not an economist. I'm pretty sure this is true because I own no bow ties and I'm also kind of an idiot with money. And as a monetary idiot, I'm absolutely baffled by how a barrel full of delicious, creamery crude oil can be below no dollars at all. In fact, as of this writing on Monday afternoon, a barrel of oil is $-35.00, which I guess means you can make almost $40 by buying a barrel of oil with no money? How is this a thing, again? I mean, even that nice steel barrel must have some value? I'm terribly confused.

Oil has never had a negative price before, but even so there are outlets making clear that, like with almost everything in economics, things are not as clear as you'd think and there's complexity and nuance and other factors that mean that, no, you can't really make a shitload of money by getting free barrels of oil.

Storage space is an issue, of course, because demand has plummeted since we're all freaking stuck at home and not driving because none of us wants to run into a certain virus I could mention and have a really awkward interaction.

According to CNBC, the oil that dropped below no money at all is part of the West Texas Intermediate (WTI) crude contract, which expires tomorrow and is for May delivery. The deadline is the key part here, since oil traders only have until tomorrow to sell off of this futures contract, and with buyers running out of storage space, traders are willing to pay $37 or so to just get the oil taken off their hands.

Other varieties of crude oil not affected by this particular deadline are not worth negative money, though their prices are certainly much less than what would normally be the case.

Soon, the WTI deadline will pass and oil won't be negative money again, but until the vast oversupply of oil is addressed, either by increased demand or, I suppose, time, oil prices are likely to still remain really low.

Remember when we were talking about Peak Oil?