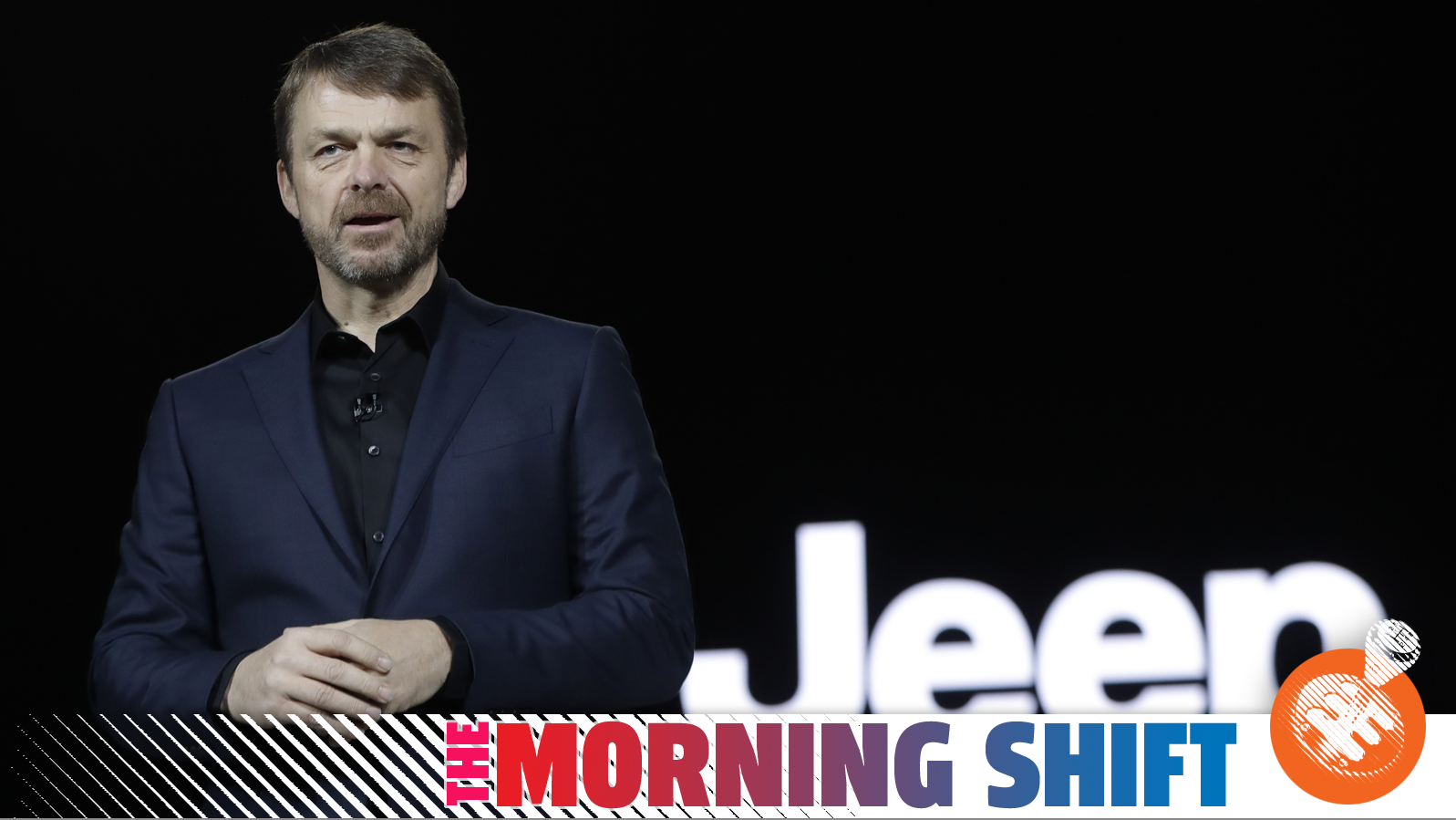

Fiat Chrysler's New CEO Is Shaking Things Up

Insight into Mike Manley's Fiat Chrysler, India's push for electric cars, the world auto market seems to be slowing, and more on The Morning Shift for Monday, July 29, 2019.

1st Gear: Mike Manley Doing Business

Ever since the untimely death of Fiat Chrysler CEO Sergio Marchionne and the subsequent appointment of former Jeep boss Mike Manley as his replacement, we haven't heard much about what FCA is like under the new boss. But Bloomberg spoke with some executives who apparently worked closely with Manley, and the news site gained some insight into Mike Manley's Fiat Chrysler.

Manley has apparently moved the CEO's quarters to the fancy, giant 15th floor office that sits behind the enormous glass Pentastar in the Auburn Hills tower building, and he's assembled a "brain trust" of outsiders and veterans. From Bloomberg:

Known as a workaholic with an icy, no nonsense demeanor, he's been busy putting his own stamp on the company, according to interviews with executives who worked closely with him. He's dispatched with Marchionne's pressure-cooker style of having top lieutenants wear multiple hats and manage vastly different parts of the business, instead streamlining divisions and assembling a brain trust of longtime veterans and outsiders from Amazon, Nike and Nissan Motor to help run them.

Mark Stewart, whom Manley hired from Amazon, now runs North America, a job Marchionne himself had done, while CFO Richard Palmer is in charge of business development, and not the systems and castings division he once ran under Marchionne. Manley also moved the CEO's office back up to the 15th floor at Chrysler's Auburn Hills, Michigan, headquarters, after Marchionne spent nearly a decade on No. 4, ostensibly to be closer to his foot soldiers.

After mentioning the enormity of Manley's tasks ahead—managing dwindling car demand in China, braving the tide of a plateauing global market in general, and staying relevant in the EV and autonomous vehicle space even without a major automotive partner (since the Renault merger attempt failed)—the story goes on to discuss transparency and Manley's plans for Ram and Jeep to continue dominating:

Executives say Manley has brought a new level of transparency. During a meeting of senior executives in Auburn Hills this past winter, he laid out the company's problems in China, from customer acceptance of Jeeps and Alfa Romeos to the number of unsold cars piling up on dealer lots. It was a striking contrast to the Marchionne era, when information was doled out on a need-to-know basis, said one person who was present.

A strong believer in the power of brands, Manley aims to expand the lucrative Ram truck and Jeep SUV divisions as twin engines of global growth. Fiat Chrysler is retooling a plant in downtown Detroit to make the next-generation Jeep Grand Cherokee at a time when crosstown rivals Ford Motor and GM are downsizing their manufacturing footprint.

Bloomberg also mentions that, back in April, under Manley's leadership, FCA "restructured its decade-old joint venture with Guangzhou Automobile Group in April," as a way to—as FCA put it—"more rapidly respond to changes in the Chinese market." In addition, he made Davide Grasso—former CEO of Nike's Converse brand—the chief operating officer of Maserati, a struggling brand whose dealerships are filled with old and rather unimpressive offerings.

Unfortunately, Manley declined to be interviewed for Bloomberg's story, but at least the story gave us a small taste of what FCA is like under his leadership.

2nd Gear: India Wants to Become a Leader in Electric Cars

Right now, China is leading the electric car revolution with its New Energy Vehicle quotas and heavy EV incentives. Europe, too, is promising to become a major EV player as more and more automakers roll out offerings, and the charging network grows ever quicker in the relatively population-dense (and thus, in some ways, more conducive to EV adoption) continent.

But it's not just China and Europe and—perhaps to a lesser degree—the U.S. hopping onto the EV train; India wants in on the fun, too. And that's a big deal, since India has an enormous population whose movement away from ICEs could spell significant pollution reductions. From Reuters:

India on Saturday slashed taxes on electric vehicles and chargers, as it looks to encourage the use of more environmentally friendly cars.

The goods and services tax (GST) on electric vehicles and chargers was reduced to 5% from a previous 12% and 18% respectively, India's finance ministry said in a statement.

According to the news site, the Indian government decided earlier in July to give tax breaks to EV buyers as part of an effort to move towards a future where electric vehicles "account for 30 percent of all passenger vehicle sales in the country by 2030," Reuters reports. This would be a dramatic increase from the sub-1 percent figure that EVs currently represent.

As the story notes, infrastructure and high battery costs are major hindrances in getting what Reuters says is the third largest greenhouse gas emitter into the world of EVs, but it seems that Finance Minister Nirmala Sitharaman is pushing for it. From Reuters:

Sitharaman said during the budget announcement that the government's plans was to make India a hub of electric vehicle manufacturing, with large manufacturing plants for lithium storage batteries and solar electric charging infrastructure.

The government also removed import taxes earlier this month on some auto components to help boost electric vehicle sales and reduce the country's dependence on fossil fuels.

This is obviously a fairly tall order considering India has quite a few infrastructural issues as it stands; adding EV infrastructure to the mix would be tough, but the rewards—both related to climate change and health issues stemming from smog—of pulling it off could be tremendous.

3rd Gear: World’s Largest Auto Supplier Bosch Predicts a 5 Percent Drop in Car Production

We keep hearing about global car demand plateauing, and what better proof than to look at forecasts from the world's largest automobile parts supplier, Bosch, who sells hardware and software to dozens of companies for use in many dozens of automobiles. Per Reuters, Bosch is expecting a bit of a dip in car production:

Auto supplier Robert Bosch has revised its forecast for automotive production on Saturday, expecting a 5% fall this year, bigger than an earlier estimate for a 3% decline, the company's chief financial officer told Boersen-Zeitung.

As a result Bosch would not be able to achieve an earnings before interest and taxes margin of 7% as it did last year, Stefan Asenkerschbaumer told the newspaper.

The good news is that the company expects plenty of revenue, since it has a major hand in developing electric cars for various automakers, especially for China. But the bad news is that—well, just let Robert Bosch's chief financial officer Stefan Asenkerschbaumer tell you. From Reuters:

"We will not be able to repeat the high margin from last year given the development in revenues," Asenkerschbaumer said, adding that he believed automotive production would stagnate over the next three years.

Stagnation. Great.

4th Gear: Detroit’s “Big Three” Could Leverage Poor Recent Financial Performance for UAW Contract Relief

Right now, the Big Three automakers remain in the throes of a contract negotiation with the United Auto Workers, and they're also going through financial issues, with Automotive News pointing out that Ford's profits dropped by 86 percent thanks to $1.2 billion in restructuring costs.

Automakers may use these recent figures to allow for more flexible contracts with the union, with the news site writing:

The latest financial figures — along with earnings reports scheduled to come this week from General Motors and Fiat Chrysler Automobiles — are likely to color this year's negotiations with the union, which kicked off talks this month by arguing that automakers' recent record profits should be shared with rank-and-file workers.

Analysts are forecasting lower earnings per share from both GM and FCA. If so, all three companies could point to the results to help justify their demands for more financial flexibility in the next contract.

The story goes on to describe the dynamic further, quoting a representative from the Center of Automotive Research:

"It's all a big struggle between what is locked down into base wages and what's part of something that can be canceled in the event of a downturn," Kristin Dziczek, vice president of industry, labor and economics at the Center for Automotive Research in Ann Arbor, Mich., told Automotive News. "Given the same set of economic indicators, the union's motivations are to make things more permanent, where the company wants to make things more contingent. I think they will absolutely use the latest quarter's profits as a sign that all good things are coming to an end and there's likely to be more caution advised ahead."

Of course, we knew automakers might use a potential recession as leverage, but, as my coworker Erik Shilling wrote, The UAW Has No Reason Not to Push for Everything.

5th Gear: EU Courts Reject BMW’s Appeal for More EV Plant Funding

BMW was apparently hoping for quite a bit of government aid to help "expand production of two models of electric and hybrid passenger cars" in Leipzig in Eastern Germany, but got shut down by the courts. From Reuters:

Germany had originally planned to grant 45 million euros ($50.1 million) toward the project, but the Commission ruled any amount exceeding 17 million euros was incompatible with internal market rules.

BMW challenged the decision, arguing that the Commission had made errors in calculating the cost of the project. It lost an initial case before the General Court of the European Union, the second highest EU court, in September 2017.

The EU's top court on Monday turned down BMW's appeal.

Reverse: GM’s 54 Day Strike in the Summer of 1998 Ends

When two parts plants in Flint went on strike, they forced production to halt at nearly 30 General Motors assembly plants and 100 parts plants in North America according to MLive. That's when things got wild for GM in the summer of 1998. From the MLive:

Approximately 193,000 North American GM workers were laid off because of the halt in production. Including the striking workers, more than 200,000 employees were jobless during the strike.

[...]

President Bill Clinton publicly called for a resolution between the union and the automaker two weeks into the strike. "I would like to encourage the parties to work it out," Clinton said of the strike. "They have, apparently, very legitimate and substantial differences, but we've got a collective bargaining system, which I support, and I think they can work it out. And I hope they do it in a timely fashion."

Eventually, after the longest strike in nearly 30 years, there was relief. From MLive:

GM and the UAW reached an agreement on July 29, 1998, before the grievances were heard by a mediator. In the strike-ending agreement, GM promised not to close several of the striking factories and to invest $180 million in new equipment for one of them, while the workers agreed to changes in work rules, including a 15 percent increase in the required daily output of parts for some workers.

Neutral: What’s the Play for Fiat Chrysler Moving Forward?

Should it stay on the truck/SUV trail? Does it need to invest more in EVs/AVs? And if yes to the latter, can it do it without a major partner?