First, Ford removed its minimum score requirement on 84-month loan terms. Now, the company has unveiled the Maverick’s financing program — and as Cars Direct reports, it should appeal to those who otherwise wouldn’t be able to get approved for financing through an automaker.

The program, called Ford Maverick Financing Guaranteed Approval Program, started in September and runs through March 2022. The main qualifier for the program is a minimum credit score of 620. There are other requirements as well:

- Loan terms cant exceed 72 months while lease terms cant exceed 36.

- Only applies to new Maverick models.

- The customer cant have any prior repos or bankruptcies.

The most important stipulations however are the PTI (Payment To Income) and loan to value ratios. For those that don’t know, the PTI is essentially a person’s ability to afford the payments on the vehicle. Ford requires that the PTI doesn’t exceed 20-percent of a person’s monthly income. The loan to value ratio is the value of the loan divided by the value of the vehicle. That ratio cant exceed 110-percent.

While this program may appeal to people who would otherwise think they couldn’t get approved for a new car, it’s problematic. The main issue is in the minimum score requirement. Cars Direct points out that no specific APR is given for this program. And for good reason too.

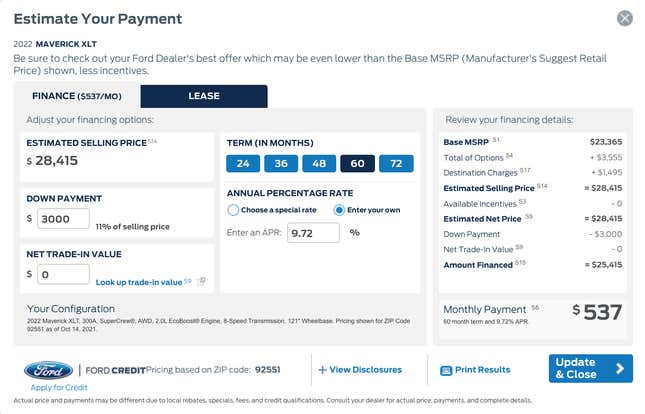

There’s no information on APR deals in this program. However, we know that Ford is currently offering special APR financing on the Maverick for 0% for 36 months; 0.9% for 48 months; or 3.9% for 72 months. No other deals or cash incentives are being advertised at this time.

APRs at a 620 to 690 score suck. No one in that score range is qualifying for an APR under five percent. APRs at this score range are usually above six percent. And the longer the term, the higher the APR because the finance company wants to make money off the interest. Using an example of someone that has a 620 score on a Maverick that’s just under $30,000 doesn’t work out to be a good deal.

Of course, not all buyers who have low scores will use this program. But it seems as if Ford has solidified the Maverick’s position in the lineup to make up for not selling entry-level compact cars anymore. Offering terrible loan terms to buyers who will most likely be young, building or rebuilding credit, on a budget or all three will only set some people up for failure.