Nissan's Pride Killed Its Merger With Honda

Plus, Trump’s tariffs are causing chaos for automakers and major airlines don’t want to pay passengers that they abandon

Good morning! It's Wednesday, February 12, 2025, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

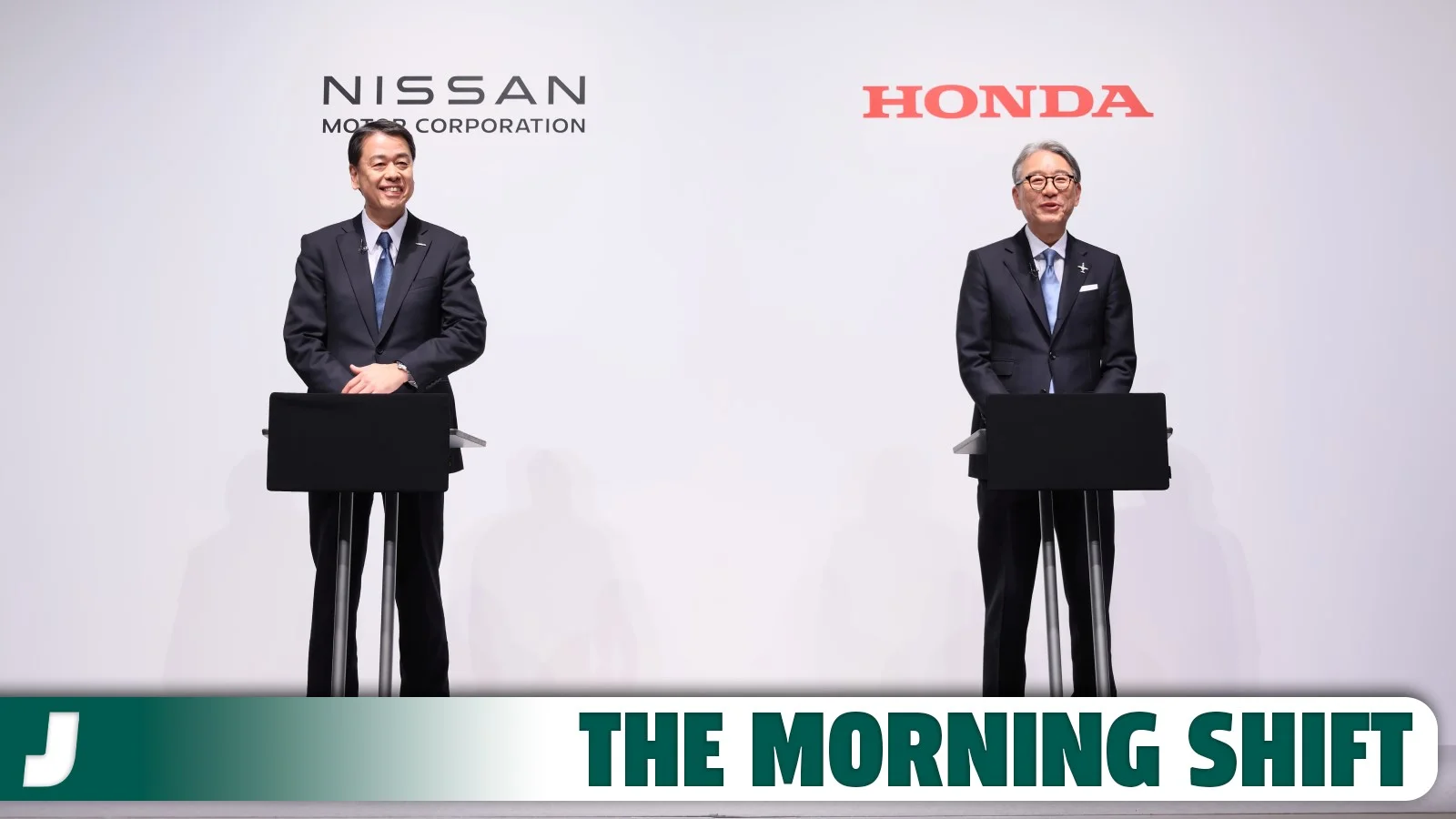

1st Gear: Nissan And Honda Merger Collapsed Over Petty Differences

The excitement was palpable at the end of last year when it was announced that Nissan and Honda were in talks to merge to better place the two automakers for the coming electric revolution. In the weeks that followed, uncertainty crept in and last week it was confirmed that the deal was off. Now, it's emerged that the reason for the breakdown in talks between Nissan and Honda was all over some pretty silly differences in opinion.

Nissan reportedly pulled out the talks once its pride got in the way of things, reports Automotive News. The brand became self-conscious about the tie up once it emerged that Honda wanted to make Nissan a subsidiary and cut its workforce to turn around fortunes at the struggling automaker:

Nissan, which for years until 2020 was Japan's second-largest automaker behind Toyota, insisted on receiving near-equal treatment in the talks despite its weaker position, three of the people said.

Honda pressured Nissan to make deeper cuts to its workforce and factory capacity, but Nissan was unwilling to consider politically sensitive factory closures, three of the sources said. They said they were left with the impression Nissan felt it could recover on its own, despite its mounting difficulties.

That intransigence, combined with what Honda management saw as Nissan's slow decision-making, helped torpedo a deal that would have created one of the world's largest automakers, three people said.

Neither automaker has confirmed the outcome of the talks, which they say are still ongoing and include discussions on every facet of the automotive world. An update on the outcome of the talks is due later this month, but it's not predicted that Nissan and Honda will be able to see past these petty differences.

This could prove to be a bigger problem for Nissan, which has slashed its targets for the year and is bracing to feel the full force of president Donald Trump's proposed tariffs on imports from Mexico. The automaker currently imports more than a quarter of the cars it sells in the U.S. from south of the border, as Automotive News adds:

"I think it's a management problem," said Julie Boote, analyst at research firm Pelham Smithers Associates, about the turmoil at Nissan. "They are completely overestimating their position and their brand value, and their ability to turn around the business."

Nissan and Honda declined to comment on the specific aspects of the talks as described by Reuters sources.

Nissan CEO Makoto Uchida visited his counterpart Toshihiro Mibe last week to say he wanted to end discussions after Honda made the subsidiary proposal.

I guess we'll just have to wait for Nissan to come up with a survival plan of its own, as it's unlikely that peddling the same aging lineup will be enough to turn around its fortunes anytime soon.

2nd Gear: Trump’s Tariffs Are Causing Chaos For American Autos

Since taking office last month, president Trump has threatened tariffs on Canada and Mexico, imposed import taxes on steel and aluminum and increased tariffs on goods from China. He's billed these moves as great for American business, but the head of Ford warns the measures could have the opposite effect.

Ford boss Jim Farley warned that instead of boosting American industry, the new tariffs would actually bring cost and chaos, reports Business Insider. The Ford CEO didn't paint a particularly pretty picture of the outlook for America, should Trump keep upping tariffs on other nations:

Farley, who was speaking at a conference organized by Wolfe Research in New York on Tuesday, said that while Trump has talked about making the "US auto industry stronger," the president's trade policies would hit Ford hard.

"So far, what we are seeing is a lot of cost and a lot of chaos," Farley told conference attendees.

"If you look at the tariffs, let's be real honest, long term, a 25% tariff across the Mexico and Canadian border would blow a hole in the US industry that we have never seen," Farley said on Tuesday.

"And it frankly gives free rein to South Korean and Japanese and European companies that are bringing 1.5 million to 2 million vehicles into the US that wouldn't be subject to those Mexican and Canadian tariffs," Farley added. "It would be one of the biggest windfalls for those companies ever."

Trump proposed a 25 percent tariff on imports from Canada and Mexico in his first week in office, but the plan was put on hold for 30 days while the two countries negotiate better deals with Trump's America. Incidentally, the deal that Trump keeps bashing between the U.S. and Canada was negotiated by, you guessed it, Trump himself. Shocker.

The backtrack from Trump on the tariffs on Canada and Mexico show that the new president's bite may not be quite as fierce as his bark. He likes throwing out threats of increased fees in order to get counties around the negotiating table, but it remains to be seen how far he would actually go with increasing import duties.

3rd Gear: Surprise Surprise, Airlines Don’t Want To Pay Stranded Passengers

Environmental targets brought in under the last administration have been backtracked, funding for electric vehicle chargers is on hold and now major airlines across the U.S. want Trump to scrap a program that would offer compensation to stranded passengers.

In the waning light of Joe Biden's administration, the government kicked off a scheme that could one day push airlines to pay out compensation to stranded passengers and people stuck with enormous delays. The program is now facing a backlash from airlines, which want Trump to step in and scrap it, reports Bloomberg:

US airlines are urging the Transportation Department to terminate an effort begun during the Biden Administration that could have required carriers to make cash payments to stranded travelers for disruptions.

That proposed review contradicts the Trump Administration's policy of reducing unnecessary regulatory burdens on consumers and will only result in a failure to improve customer service, Airlines for America said in a letter to the department Monday. The request for public feedback on the planned proposal originated in the closing month of Biden's term and was one of several consumer-protection initiatives pushed by former Transportation Secretary Pete Buttigieg.

The review "raises substantial questions of fact, law and policy," according to Airlines for America, the lobbying group representing the nation's largest carriers, including American Airlines Group Inc., Delta Air Lines Inc. and United Airlines Holdings Inc. The premises for the review — that airlines cause significant harm for consumers — "are entirely wrong or significantly flawed."

Under the new scheme, airlines would have to pay between $200 and $775 to passengers if their journey is hit by delays or disruption. Operators could also be required to offer food to delayed passengers and cover the costs of hotels if required.

Under some circumstances, airlines are already required to offer food, accommodation and refunds to passengers caught out by travel chaos. The new scheme would go further, though, and that's why operators want Trump to freeze the review of the new policies. If Trump does cave to the demands of airlines, it'll be further proof that America First actually means American Business First, and not American people.

4th Gear: Global EV Sales Up In January

In a positive end to The Morning Shift today, there seems to be no stopping the rise of global electric vehicles sales after deliveries were up by 18 percent in January, according to Reuters.

Sales of electric and plug-in hybrid vehicles were up by almost a fifth compared with the same period last year, the site reports. The global growth was boosted by demand in places like Europe and the United States, as the site explains:

Global electric and plug-in hybrid vehicle sales in January rose 18% year on year, as growth in Europe and the United States outpaced China for the first time since last February, research firm Rho Motion said on Wednesday.

The European car market started the year on a strong footing as CO2 emission targets came into effect in the European Union, while holidays during the Chinese New Year led to a 43% month-on-month drop in the country's sales, Rho Motion data manager Charles Lester said.

In the United States and Canada, EV sales hit 0.13 million units last month after a 22.1 percent increase compared with January 2024. There was similar growth in Europe, which grew 21 percent and shifted almost double the number of electrified cars.

In the U.S. buyers rushed to make the most of the incentives that were available to EV shoppers under the previous administration. With the new big orange boss in charge of things, we'll have to wait and see what an end to subsidies does to U.S. electric car sales, which will become apparent when next month's figures are published.