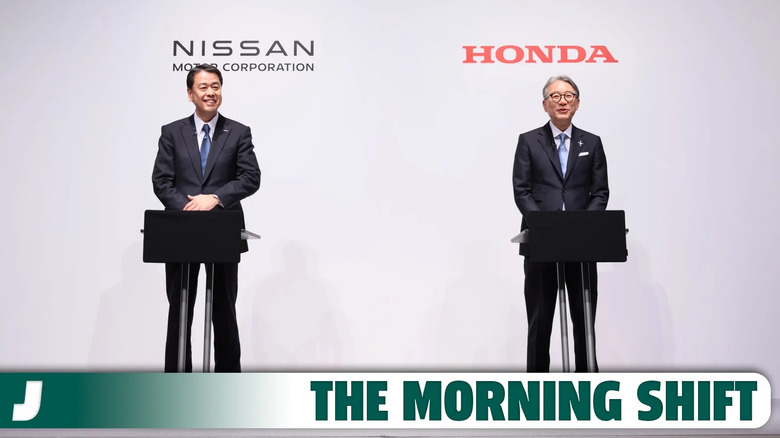

Honda's Merger With Nissan Is Probably Over Before It Even Began

Good morning! It's Wednesday, February 5, 2025, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

1st Gear: Nissan Backs Out Of Honda Merger Talks

It seems like only yesterday we were all excitedly thinking about another enormous automaker rising to the fore after it was revealed Nissan and Honda were in talks to merge. Now, hopes of another powerhouse in Japan have been dashed as it's emerged that Nissan might not be interested anymore.

Way back in December 2024, Nissan and Honda revealed that they were in talks to merge, but a report has revealed that Nissan might be backing out of the negotiations, according to Automotive News. Nissan has reportedly walked away from merger talks after it emerged the company would become a subsidiary of Honda, as the site explains:

Nissan had been discussing further integration following their announcement to discuss merging under a new company by August 2026.

But talks broke down following Honda Motor Co.'s proposal to take a stake directly in Nissan Motor Co. and make Nissan a subsidiary of Honda, the Nikkei reported Feb. 5. Japan's NHK public broadcaster reported Honda's proposal the previous day.

The companies will take a break and consider other ways to pursue integration or cooperation, including in the field of electric vehicles, the Nikkei said.

Nissan reportedly went into the merger talks hoping for "integration on equal terms," the site adds, while Honda was hoping for greater restructuring at Nissan to try and turn around its money worries. The two ideas haven't gelled, but neither company has so far confirmed if merger talks are off.

Instead, the two companies have confirmed that talks between them are ongoing, covering "various matters" such as the development of joint EV platforms and the aforementioned merger. An update is due from the two brands "by mid-February," Honda added.

When the merger talks were first announced, it was hoped that the collaboration between Nissan and Honda could see it take the fight to Toyota, which is the world's largest automaker by volume. Through the tie up, the future of both companies could be more secure, and development costs of new electric platforms could be shared across multiple models.

Initially, it was thought that the merger could also involve fellow Japanese automaker Mitsubishi, but the brand distanced itself from merger talks earlier this year.

2nd Gear: Elon Musk's Politics Have Hit Tesla Sales In Europe

With Tesla boss Elon Musk caught up in a race to space, controversies over his company that creates brain implants and his close ties to the presidency of Donald Trump, you'd be forgiven for forgetting that his day job involves selling cars. Now, it appears as though Musk's extra curricular activities are having an impact on Tesla's performance, and not in a good way.

The electric vehicle maker saw deliveries drop for the first time in a decade over the course of 2024, and it's now emerged that Musk's politics are putting off buyers around the world, as sales continued to fall in January 2025, reports Automotive News:

Musk has made a high-profile foray into politics, with much of his 2024 dominated by his financial support of Donald Trump, on whom the billionaire CEO spent $250 million in what proved a successful campaign to return to the White House.

He has also stirred controversy with his vocal support for far-right parties in Britain and Germany on his social media platform X.

Tesla's U.K. sales fell nearly 12 percent in January, even as monthly EV registrations in Europe's biggest battery-electric market surged to a record, according to data published by New AutoMotive on Feb. 4.

That follows a 63 percent decline in January sales for Tesla in France, drops of 44 percent and 38 percent in Sweden and Norway, and a 42 percent fall in the Netherlands.

The drops are significant and follow a similar decline in deliveries for the automaker at home. Tuesday, we reported that Tesla shipments in California were down double digits. The Model 3 was the biggest disappointment in the Sunshine State, with deliveries dripping 36 percent over the course of 2024.

Tesla is likely to face more challenges in the coming months, as other European nations call for a boycott of the brand following Musk's Nazi-like salute at an inauguration event for Donald Trump. The company will also have to contend with tariffs on Chinese goods, as it produces some of its cars at a factory in China, and rapidly dropping support for EVs on a federal level.

3rd Gear: GM Cuts 1,000 Cruise Jobs

If Tesla's star is starting to tarnish, Cruise's star has dulled and fallen back down to Earth in dramatic style. After rolling out a self-driving taxi service in San Francisco just three years ago, the GM-backed autonomous vehicle maker was wrapped up just last year as its parent company announced it would focus on advanced driver assist tech, like Super Cruise.

Now, General Motors is gutting the staff at Cruise and has reportedly cut 1,000 jobs from the autonomous vehicle startup, the Detroit Free Press reports. The Chevrolet owner completed its acquisition of Cruise yesterday, and ha moved quickly to downsize the organization:

General Motors on Tuesday completed its acquisition of the Cruise autonomous vehicle unit, laying off half the workforce. The 1,000 who remain at General Motors will be folded into the company's advanced driver assistance systems engineering, which includes the company's SuperCruise technology.

Those laid off were based in California, Arizona and other locations. A GM spokesman said no Michigan workers were laid off in the move.

Laid-off Cruise employees were informed Tuesday as GM completed its consolidation of the former robotaxi business arm. About 80% of the engineering and technical teams will be maintained, according to the company. GM axed a mixture of administrative roles, though a GM spokesperson would not clarify further.

Before the job cuts started, GM bought the remaining stock in Cruise that it didn't already own to take full control of the AV startup. At the end of last year, GM recorded a $500 million charge related to the consolidation of Cruise, which was when it bought out minority shareholders and took on 97 percent of the company. Tuesday, GM took control of the remaining three percent.

GM will now use the tech developed at Cruise to develop its advanced driver assistance tech, Super Cruise. The tech is currently available on 250 GM models and allows drivers to operate their vehicle hands-off on 750,000 miles of roads in North America.

4th Gear: Ferrari is Doing Just Fine

While regular automakers are dealing with job cuts, falling sales and are looking into partnerships in order to survive, supercar maker Ferrari isn't concerned with such things. In fact, the Italian automaker is practically thriving while the rest of us struggle with rising living costs and ever-increasing monthly car payments.

As such, Ferrari reported that sales of its supercars rose 14 percent over the course of 2024 to hit $1.8 billion, reports Bloomberg. The automakers strong results came as sales grew in markets like the U.S., while Ferrari saw a drop in demand in China:

Shipments rose 1% to 13,752 units in 2024, driven by sales of the Purosangue, Roma Spider and 296 GTS, Ferrari said.

Sales in the Americas, mostly in the US, surged 8% in the final three months of the year. China sales dropped 38% in the quarter, accelerating a slump in the country, though it remains a smaller market for Ferrari than its competitors.

Ferrari may revise its strategy in China amid growing demand for luxury electric vehicles in the country, Vigna said on a call with reporters. The manufacturer could rethink its current cap on China sales of 10% of total shipments to chase opportunities in the EV era, he said.

Ferrari isn't expecting this growth to slow, in fact it's projecting "robust" growth in 2025 that could see sales for the year surpass €7 billion and earnings of "at least" €2.68 billion, Bloomberg adds.