More General Motors contract news, future emissions regulations in the U.S., Nissan’s plans for the future, Volkswagen’s bet on the electric ID.3, and Faraday Future is still a thing and still raising money to stay one. All of this and more in The Morning Shift for Wednesday, Oct. 23, 2019.

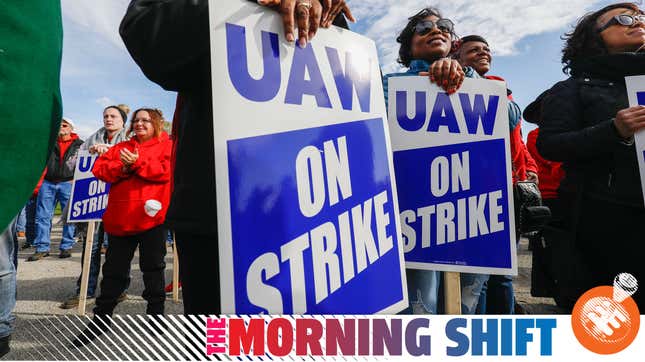

1st Gear: The GM-UAW Tentative Deal

The United Auto Workers union and General Motors have a tentative contract agreement in place after the UAW made its biggest move to go on strike since a two-day walkout in 2007. With the tentative agreement comes the weighing of the pros and cons, and Automotive News has a pretty good breakdown of who’s winning and who’s losing in the current agreement.

One of the big winners, in Automotive News’ mind, is the Detroit-Hamtramck Assembly plant. Here’s its take:

While GM won the ability to close plants in Ohio, Michigan and Maryland, the union secured a big win in keeping open GM’s Detroit-Hamtramck Assembly Plant, which was scheduled to close in January. Workers there will get the opportunity to build electric trucks, vans and battery modules, which represents a $3 billion commitment. While the union has voiced concern over electric vehicles, and while EVs remain a tiny portion of the market, the allocation cements the job security for up to 2,225 people at full capacity. If that doesn’t secure their “yes” votes, nothing will.

The story also has a big breakdown of what the tentative agreement means for new hires, putting them in the “losers” category:

The union secured a win for all current workers, who will be making top wages of $32.32 by the end of the current deal. But the fate of new hires is a little less clear.

All current full-time temporary employees with at least 3 years of continuous service (layoffs up to 30 days don’t count) will become permanent employees in 2020.

New temporary workers hired after the date of the contract, however, start at $16.67 per hour. There is no language about pay raises or promises to move directly into full time employment. In fact, a section from prior deals saying they’d be considered for regular job opportunities has been crossed out. Instead, part-time temps will only be considered for full-time temp jobs, with the opportunity for permanent employment after serving two years as a full-time temp.

It’s also unclear if new full-time hourly employees would be placed on the new, condensed four-year grow-in to top wages that current full-time employees won.

Automotive News has a full, comprehensive list here.

2nd Gear: New U.S. Emissions Regulations Will Be More Restrictive Than We Thought: EPA Chief

The Trump administration’s Environmental Protection Agency head said this week that new emissions regulations will be out this year and will be stricter than we thought, Reuters reports. It’s been a major topic for years now, with the administration fighting with the state of California, other states and automakers over its want to loosen Obama-era fuel-economy regulations.

There weren’t any details given about what the new regulations will hold, but EPA administrator Andrew Wheeler said in a recent speech that the plans are “actually more restrictive on CO2 emissions than the Obama proposal was” as the proposal from the Trump administration will get rid of some of the elements that make it easier for carmaker to comply.

Here’s background on how we got here and where we’re going, via Reuters:

The Trump administration is embroiled in a legal battle over automotive tailpipe emissions with the State of California and other states that want to keep Obama administration standards, which call for pushing the average fuel efficiency of new vehicles to 46.7 miles per gallon by 2026.

The Trump administration’s earlier proposal called for freezing the average vehicle fuel efficiency target at 37 mpg. Wheeler said he is hopeful California regulators will have a different view when they see the administration’s final proposal.

Only three automakers complied with U.S. fuel efficiency standards in 2017, Wheeler noted, saying the Obama rules “are not based on reality.”

The Trump administration, you’ll remember, is all about “safer cars versus more fuel-efficient cars,” which is a logical carnival ride since those two things are not dependent on each other. The president believes that fuel-efficient cars “like papier-mâché. Somebody touches them and the entire car collapses.” That could not be further from the truth.

Anyway, Reuters has more on the story here.

3rd Gear: Nissan Could Axe Certain Products; Assembly Lines; Datsun Brand In Push For More Profitability

Nissan wants to “boost profits by getting smaller” as it looks at things post-Carlos Ghosn, two unnamed company sources with direct knowledge of the matter told Reuters in a story published on Wednesday. That means, according to the story, axing unprofitable products, assembly lines and likely the Datsun brand.

Nissan’s calling the move the “performance recovery plan” internally, Reuters reports, and is a result of Nissan under Ghosn doing anything possible to meet sales targets—including “practically giving away cars” to fleet buyers, Reuters quoted a source as saying. From the story:

The plan is the Yokohama-based automaker’s latest attempt to pull itself out of crisis after Ghosn was arrested for financial misconduct - charges he denies. The scandal has further strained an already dysfunctional alliance with Renault SA and thrown Nissan into disarray as it finds itself on course to book its lowest operating profit in 11 years.

The sources said Nissan will likely kill loss-making variants for the Titan full-size pickup. Unprofitable variants include the single-cab and diesel versions.

A planned shuttering of underutilized production lines will most probably hit plants in emerging markets building Datsun and other small cars hardest, they added.

Nissan declined to comment on the story, Reuters reported.

4th Gear: Volkswagen’s Bet on The ID.3

Volkswagen, over the past few years, hasn’t looked the greenest. The discovery of the massive Dieselgate emissions scandal among automakers began with it, and cheating emissions isn’t a great look. But the automaker is on the PR and product campaign to turn that all around, and the all-electric ID.3 hatchback is one of its starting points.

Bloomberg has a big story on the coming of the ID.3, part of Volkswagen’s post-Dieselgate decision to spend nearly $50 billion on EVs after the scandal cost it more than $30 billion. From Bloomberg:

The ID.3, scheduled to hit the streets by midyear, is the first of at least 70 electric cars in VW’s pipeline. It will begin rolling off German assembly lines in November, and in 2020 two factories in China will start production, allowing VW to build more cars annually than Tesla Inc. has sold in its entire history. By 2022 the company expects to have eight facilities around the globe making battery-powered vehicles, from the ID.3 to cargo vans to Porsche’s four-door Taycan.

While the ID.3, priced from around $30,000 with a range of 200 miles or more, is aimed at countering the threat from Tesla’s Model 3, its stiffest competition will come from gasoline-powered cars such as VW’s own Golf hatchback. The company has made an electric Golf since 2012, but the vast majority of sales are for combustion versions, and Volkswagen on Oct. 24 plans to unveil the latest iteration of the model as it seeks to straddle the old and new worlds.

Bloomberg has more here.

5th Gear: Faraday Future Still Kicking; Raising Money

Oh, you thought electric-car startup Faraday Future wasn’t a thing anymore? That probably wasn’t too far fetched, given that its entire existence has been, well, questionable. But Faraday Future is still alive and kicking, and hey, it’s looking for some funds if you have any.

Bloomberg reports that Faraday’s new chief executive wants to gather roughly $850 million by the first quarter of next year, because Faraday has cars to build:

The company plans to use proceeds from the upcoming funding round as a bridge to an initial public offering, Chief Executive Officer Carsten Breitfeld said in a phone interview. He took over the job weeks before Jia Yueting, Faraday’s founder, filed for bankruptcy in the U.S. after running up billions of dollars in personal debts trying to build a business empire in China.

Faraday, which is less than six months removed from securing $225 million of financing, will select a lead investor for the upcoming round by the end of this year, and both new and existing backers will participate, Breitfeld said. The company’s capital needs mean an IPO “cannot be in the too far future” while acknowledging that conditions for an offering aren’t ideal.

We’ll see how all of that goes.

Reverse: Skyfall Premieres

On Oct. 23, 2012, the 23rd James Bond movie, Skyfall, premiered, along with these red-carpet photos from the Guardian. Seven years later, we’re awaiting Bond 25.

Neutral: How Much Of Your Next Paycheck Is Going to Faraday Future?

Don’t lie. All of it.