IRS Deems Some Tesla Model Ys Too Light For EV Tax Credit

Two-row versions of the Model Y aren't heavy enough to be classified as SUVs for the higher MSRP cap bracket.

The five-seat versions of the Tesla Model Y may not be eligible for the $7,500 federal EV tax credit. Engadget spotted that our friends at the Internal Revenue Service haven't categorized specific variants of the electric crossover as sports utility vehicles.

In theory, every Model Y could be eligible for the federal tax credit under the new 2023 guidelines. The four-door hatchback easily exceeds the minimum seven-kilowatt-hour battery capacity requirement and is assembled in the United States by a qualifying manufacturer. However, the five-seat, two-row versions of the Model Y are too light to be considered SUVs by the IRS. The federal taxation agency requires SUVs to weigh more than 6,000 pounds. No Model Y exceeds 4,400 pounds. All-wheel-drive Model Ys could have been classified as SUVs having met the weight requirement, if they also met several axles and ground clearance requirements.

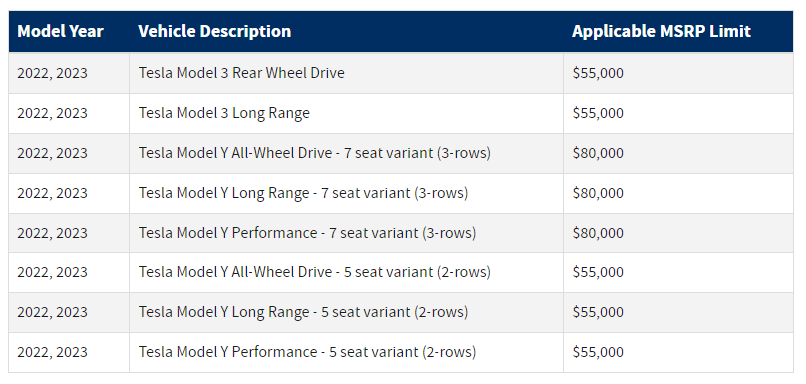

The vehicle type categorization might seem insignificant, but it drastically shifts the MSRP limit for credit eligibility. The price cap for vans, SUVs and pickup trucks is $8,000. For all other qualifying vehicles, the cap is $55,000. This cap is where the Model Y runs into its crucial dilemma. The Tesla Model Y Long Range and Model Y Performance currently retail at $65,990 and $69,990, respectively. Both trims are priced below the cap for SUVs but above the cutoff for cars.

The new guidelines are set to be finalized this March, so they could be amended to include all Model Ys. The federal government aims to accelerate electric vehicle adoption, but these guidelines encourage manufacturers to build heavier EVs to sell them at higher prices. Though, the consequences of promoting larger vehicle sales aren't unknown. For example, road damage caused by vehicles driving over the surface increase exponentially with vehicle weight.