Typically when a consumer leases a car, they won’t be in a position to make money on that agreement. Also, if they want to exit that lease early, it can be very costly. Due to the current madness in the used car market, however, certain leased cars can mean profits for lessees. Just be careful, there is something of a catch.

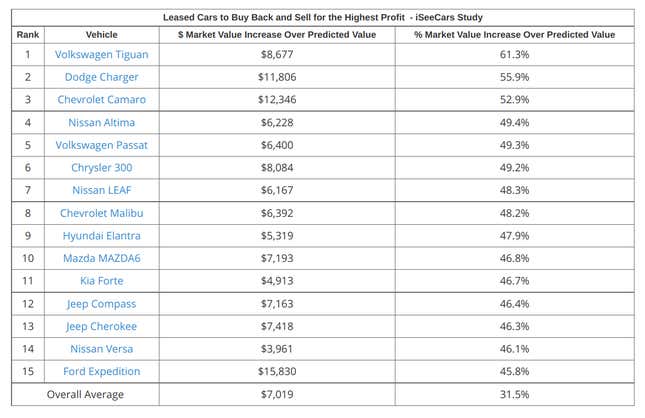

Our friends at iSeeCars examined the increase in used car values and compared that to the projected residual (resale) value for various models in a new study. What they found is that certain models are worth way more than predicted. That could mean some cash in the pocket of the lessee if they decided to sell that lease instead of giving it back

From the study:

According to iSeeCars.com’s latest analysis of nearly 10 million car sales, the average three-year-old used car is worth 31.5 percent, or $7,019, more than its residual value estimated at the beginning of its leasing term. iSeeCars compared the projected three-year residual values of new cars from 2018 to current used car prices for three-year-old cars to see which can likely be purchased at the end of their lease term and sold for the highest profit.

While these numbers are pretty amazing, I feel the need to hedge this a bit. I don’t want you to think that just because you are leasing a Tiguan, you’re going to be making an $8,000 profit if you buy out that lease and re-sell it. As a professional car shopper, I have advised dozens of my clients with current active leases to get purchase offers from Carvana, Vroom, Carmax, and local dealers. Of course, they would then compare those offers to the buy-out amount on their lease. There has been a consistent pattern of those purchase offers to be substantially higher than the residual/buyout. Though, I have yet to see differences that total up to $7,000 or more. Remember, your car is worth what someone is actually willing to pay. So if you are leasing any of these cars, get actual offers from outfits that are going to give you money, then make the comparison to what you would owe on the buyout.

Also, as I mentioned in a recent post some brands do not allow for what is called a “third-party lease buyout.” That is, Carmax, Carvana, or any other dealer cannot just buy out the lease from the leasing company and apply whatever equity you have towards your next purchase. Several brands are restricting these practices, but the individual lessee can buy the car out for themselves and choose to re-sell it elsewhere. Buyers should be aware that if you buy out your own lease to “flip it” you will likely have to pay your local sales tax on that purchase, which will cut into any potential profit.

Lastly, I have seen too many consumers focus on the potential profit of their used cars, but what they haven’t considered is what the price will be on the replacement. Inventory is slim and deals are hard to come by. Often what happens is that whatever profit is made on the sale gets neutralized on the next purchase due to many popular models selling for MSRP or more. It’s always important to examine the big picture before you decide to off-load your lease.