As Jalopnik’s resident car-buying expert and a professional car shopper, I get emails. Lots of emails. I’ve picked a few of your questions and will try to help out. This week we are discussing how much intervention automakers do with poor dealers and “actual market value” coverage for insurance.

First up, how much do the automakers really care that they have crappy dealers?

“I read your post last week about the Hyundai dealer in Florida wanting to ‘establish a relationship before sending a price. We had a recent experience with a Kia store. We wanted to test drive a new Telluride and made an appointment. Once we arrived we were told that they would only allow test drives if we agreed to a $10,000 markup on the car, otherwise, we couldn’t try it out. It would have been nice of them to tell us that ahead of time as we would have saved a trip. This totally soured us on the brand. I don’t care how nice of a car that Telluride is, I refuse to buy a Kia after that experience. Do these brands really care that their dealerships are potentially costing them customers? I guess with the current inventory shortage and hot car sales it doesn’t matter that much.”

I can’t speak for all brands, but in the interactions I have had with a few automaker representatives they have expressed concerns about how their brand is being represented at the dealer level. In fact, a Hyundai representative did reach out to me regarding my post last week to get more details about that situation. So on some level, they do care, the key question is what, if anything, are they going to do about it?

Unless a dealer conducts illegal activity, due to franchise law protections there isn’t a lot an automaker can do to “force” a dealer not to be slimy. Most automakers have in place some kind of bonus system for sales staff based on customer experiences. The problem is that this system is implemented post-sale, and due to the nature of how these surveys are scored they aren’t terribly fair nor always accurate. Furthermore, brands don’t really have a system in place to score the sales that never happened because the customer got a bad experience and went elsewhere.

Too often brands focus on product and not the sales experience in order to gain market share, because the product is what they have the most control over. Altering the dealer network landscape would require some significant investment and likely face a lot of resistance. That’s not to say it can’t be done, but if these stores are selling cars even if customers aren’t happy about the transactions I don’t see automakers doing much to overhaul that system.

Next up, will my insurance company only pay “book value” on a car that is “worth” a lot more?

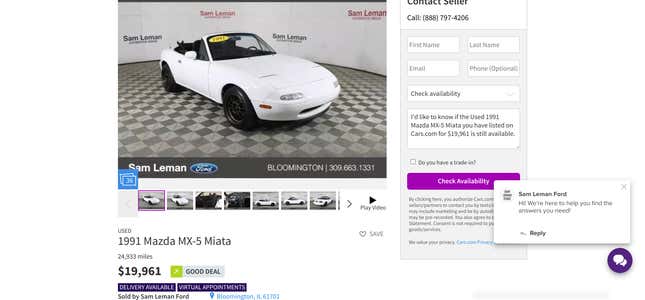

This 1991 Mazda Miata is up for sale for about $20k:

If I were to purchase this car, my full insurance coverage on the car states that if it is written off I will receive actual market value. I spoke to my insurance provider and they said that I would most likely receive roughly the KBB value. The KBB value on these cars even with low mileage is roughly $4k.

Given that I paid $20k for the car, would I really be out $16k if it is written off?

If your insurance company is telling you straight up that they will use KBB numbers to estimate the “value” of that Miata, then it would seem that about $4,000 is all you would get if the car was totaled. One of the problems with a lot of these Radwood era cars is that the “market value” is not really recognized by most insurance carriers since these vehicles aren’t technically “vintage” or “collectible” quite yet. Depending on how you plan to use the Miata and whether or not you have another “daily driver” one of the collector car insurance companies like, Heacock, Grundy or Hagerty will likely be your best bet. Those policies are generally much cheaper than your regular car insurance and the companies tend to be more knowledgeable when it comes to the values of collectible cars.

Got a car buying conundrum that you need some assistance with? Email me at tom.mcparland@jalopnik.com!