Tesla’s moonshot value is freaking people out, the Coronavirus could actually help balance Chinese vehicle production, gas cars just got Brexited, and all that and more in The Morning Shift for Tuesday, February 4, 2020.

1st Gear: Tesla’s Valuation Is Out Of Control

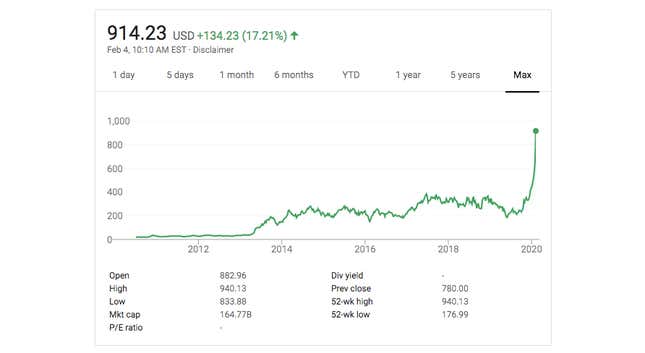

Tesla’s stock price jumped to over $900 before trading earlier today, proving the recent surge in value had more juice than many presumed and leading a lot of smart stocks people to feel very dumb. Naturally, they want an explanation, and it probably has just as much to do with Tesla’s successes as it does every other automaker’s failures to catch up.

From Bloomberg:

[Musk] has built a commanding lead in the still-fledgling U.S. EV market, and the Model 3 has risen to become one of the top-selling cars in Europe — electric or otherwise. Tesla needed only a year to construct its first overseas assembly plant in China and last month started deliveries of locally built sedans. By March, it plans to begin handing over Model Ys to customers, months ahead of schedule.

“We think they are pretty far ahead in battery and EV technology,” Adam Jonas, an analyst at Morgan Stanley, said in an interview. “Tesla has moved from being seen as an auto stock to be seeing as a tech stock” that is “mentioned in the same breath as Amazon, Apple and Google.”

I hate the argument that Tesla should be treated as a tech company, as it lets them get away with calling their advanced cruise control a “beta test” that sometimes crashes and kills people. Cars are much harder than phones to build and prevent from killing people.

Also, Tesla makes cars. It just does. It’s a car company.

Rather, I think perhaps this should open us all to the realization that other major automakers should be valued higher than they currently are, considering Tesla still doesn’t have the same impact on the global market share of cars like, say, Volkswagen or Ford or Toyota, etc.

2nd Gear: Coronavirus Will Likely Disrupt Global Auto Output

The Chinese automotive supplier and manufacturing industry is in a bit of a crisis after a region responsible for a lot of manufacturing output just happens to also be near the epicenter of the deadly Coronavirus outbreak.

From Bloomberg:

Provinces that extended the Lunar New Year holiday period include Guangdong, which accounts for 12.8% of light vehicle production, and Hubei, where the outbreak’s epicenter Wuhan is located. Hubei, in central China, chalks up 9% of Chinese auto production and more than 3.5% of demand. The shutdown will ripple through the supply chain – Hubei is home to hundreds of small- and medium-sized parts suppliers.

Already, Toyota Motor Corp. has suspended production of cars in China until at least Sunday. Tesla Inc. has been told to halt work at its Shanghai factory. The disruption in auto parts forced Hyundai Motor Co. to interrupt making its Palisade sport-utility vehicle in South Korea last weekend and it’s considering breaks at other plants.

The impact will be significant. If production stops for two weeks in China’s six major regions, output will drop around 8% this quarter, Goldman Sachs Inc. analysts estimate. But it’s worth considering what this actually means for a manufacturing industry that has been running on overdrive, with little incentive to rein in the daily churn.

This Bloomberg article argues the disease delays could actually be a good thing for the market, reducing excess operating capacity and better balance output with a general reduced demand as the Chinese automotive sector slips into declining growth for the first time in decades.

3rd Gear: Gas And Diesel Just Got Brexited

Freshly Brexited, Britain is quickly making moves to establish that it’s still serious about curbing emissions on its tiny island nation, despite ejecting itself from the European Union. The move now is to take previously existing plans and just move them up five years earlier, via Reuters:

Britain will ban the sale of new petrol, diesel and hybrid cars from 2035, five years earlier than planned, in an attempt to reduce air pollution that could herald the end of over a century of reliance on the internal combustion engine.

[...]

Britain’s step amounts to a victory for electric cars that if copied globally could hit the wealth of oil producers, as well as transform the car industry and one of the icons of 20th Century capitalism: the automobile itself.

I’m all for hitting the wealth of oil producers, and 15 years seems like a reasonable amount of time for the auto industry to get its shit together and develop some decent electric cars, or consolidate its way to find another company that’s already done all of the work.

This also doesn’t mean the gas and diesel cars currently on Britain’s roads, as well as all the ones to come over the next 15 years, are going to go anywhere overnight. But this is progress, and the sooner the better.

4th Gear: U.S. Auto Sales Fine Last Month

Seasonal depression has not gotten in the way of crossover sales, at least not for the month of January, according to Automotive News:

Toyota said volume rose 5.5 percent at the Toyota division and 13 percent at Lexus, with overall light-truck sales rising 11 percent and car deliveries slipping 1.1 percent.

Hyundai said retail demand for crossovers rose 54 percent to 25,110 last month, offsetting lower car sales and a 68 percent drop in fleet deliveries. Overall, crossover sales totaled 25,861, up 23 percent and a January record, the company said.

At American Honda, car sales dropped 11 percent while the company’s light-truck deliveries rose 0.9 percent to a January record of 59,254. Volume fell 4.2 percent at the Honda brand, behind weaker Accord and Civic demand, and 5.5 percent at Acura.

Subaru, one of the hottest brands over the last decade, said it set a January sales record with 46,285 car and light-truck deliveries.

A growing crossover lineup also drove Mazda to an 18 percent gain last month. The company said combined sales of four crossovers — the CX-3, CX-30, CX-5 and CX-9 — increased 41 percent to 18,974, helping the brand’s volume rise for the fourth straight month.

Among other brands, January volume rose 22 percent at Mitsubishi; 14 percent at Genesis, where deliveries have increased 12 straight months; and 5.2 percent at Volvo, which has now posted 13 consecutive gains.

While these figures don’t represent the American market as a whole as other companies shift to quarterly reports instead of monthly, it proves that if you want growth, you sell more light trucks and crossovers. And look at Mitsubishi go! Good for it.

5th Gear: Chicago Is Sort Of Cool This Year

Jalopnik doesn’t really go to the Chicago Auto Show. Most years it’s just a show of reruns from the other shows we’ve already been to and covered, but this year it’ll be an opportunity to see a lot of fresh sheet metal in person for the first time in the States.

While there aren’t many all-new reveals planned, according to Auto News, we will get to see U.S. market versions of the new Jaguar F-Type, the Genesis GV-80, the redesigned Chevy Tahoe and Suburban and GMC’s Yukon, a hybrid Hyundai Sonata, updated Kia Cadenza, new special edition Toyota pickups, an updated Volkswagen Atlas, and the refreshed Honda Civic Type R.

So it’s a lot of mild facelifts. Cool.

Reverse: Ford Buys Its First Car Company

Neutral: Value

Do you think other automakers should be more “fairly” valued among tech companies and Tesla, or do you think Tesla’s valuation needs to be cut back down to size to match closer to the other automakers?