You're Probably Underestimating How Much Your Car Is Costing You

There is insurance, registration fees, inspection fees, parking fees, repairs, fuel, tolls, maintenance, speeding tickets, traffic cameras, the cost of the car itself, and tools, if you work on your own car. It all quickly adds up.

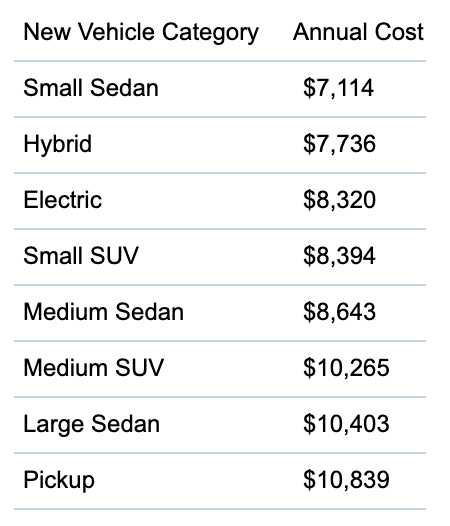

It also depends on what kind of your car you drive, since a small sedan will be cheaper to maintain than a truck. According to AAA, those costs average out as follows:

AAA's study is an estimate on new car ownership for five years and 75,000 miles, and accounts for what AAA says is a steep and recent rise in financing costs, as well as fuel, maintenance and repair, insurance, registration and taxes, and depreciation.

That means AAA's study doesn't even account for a few other categories that I mentioned, but, still, these numbers might seem big to you, and, according to a new study, you're not alone. That's because when a lot of people think about how much it costs to own a car, generally they're only thinking about two things: their monthly payment and fuel, even though it's so much more.

The study, published this week by four economists in Nature, surveyed 6,233 car-owning Germans and asked them what they thought they were spending on their car versus what they actually were. The economists found that, on average, people estimated they spent just over half of what they were actually spending.

Emphasis mine:

We also investigated the four main costs of car ownership: fuel, depreciation, repair, and tax and insurance. On average, respondents came very close to perfectly estimating how much they spent on fuel, consistent with the previous literature13. But they severely underestimated all other major expenditure for running their cars (see 'Costly misjudgement'). To our knowledge, this misjudgement has not been reported previously, and it can provide leverage points for designing new transport policies.

The study also found that depreciation was the most common underestimate, while those who underestimated their repair costs tended to underestimate them by a pretty big margin compared to the rest, as did those who underestimated their insurance and registration costs.

The authors of the study use this information as a jumping-off point to argue that if consumers were more fully informed of a car's cost, perhaps they would make a different type of purchasing decision, or perhaps they would push for better public transportation, or perhaps they would choose to forgo a car at all, and all of that together might improve the climate.

That all seems possible to me in Europe, where public transportation is taken seriously, though less plausible here in the States, where we regard public transportation as a conspiracy to destroy personal freedom and the vast majority of this country is inaccessible unless you have a car.

So instead, let's return to the AAA study for a moment, and the question of finance charges, which the Nature study didn't even bother to account for because they were trying to be conservative.

The AAA study was published last year, which means that the following paragraph is a little terrifying in light of recent events that has shoved the American economy into disaster.

The spike in finance charges – which rose from $744 to $920, a nearly $200 increase — was fueled by rising federal interest rates and higher vehicle prices. It comes as 72-month car loans have become increasingly common – meaning car buyers are paying more, and longer, for vehicles that lose value the moment they're sold. Long-term loans offer lower monthly car payments, but they ultimately cost the consumer more. AAA found that, on average, every 12 months added to the life of a loan adds nearly $1,000 in total finance charges.

It's a good thing that 84-month loans aren't becoming more common. What? You're telling me that they are? Hmm. It seems, in any case, that a bad economy will force a lot of people to reevaluate what they're spending their money on. And with your car you can easily do the math yourself, but don't sleep on depreciation.

The math for me looks like this: I took out a $9,600 loan to pay for it in January 2014, paying $854 in interest over the life of the loan, making the purchase of the car cost $10,454 in total. A quick look at Craigslist suggests I could probably get around $4,000 for it these days—assuming I could sell the car at all in a pandemic—which is $1,000 per year in depreciation on average. I pay $1,240 per year for insurance, $40 every year to have the car inspected, and around $100 every two years to renew the car's registration. I also reliably rack up one or two parking tickets a year, which we'll say costs another $100. I have no idea how much I've spent on maintenance and repairs, though I'll estimate that to be around $4,000 over the entire time I've had the car, even if that's probably generous. I average about $200 per year in tolls, and spend about $40 a month on gas (I tend to only drive on weekends).

Assuming the same depreciation rate, that means car ownership costs me around $3,680 a year, in this extremely back-of-the-envelope calculation, which feels about right, given that AAA says a new small sedan costs an average of $7,114 annually. The gap between the two numbers is largely because my car loan is paid off.

Let me know in the comments how much you pay if you want! Until now I did not know it was that high for me, even if that also seems about average, though I had a bad feeling about it. Of course there is also the possibility (probability? I am an idiot so let's go with that) that every step of the way I got completely hosed.