Here's Where Women Pay More For Car Insurance Than Men: Study

Get in loser. We're going to pay more for car insurance.

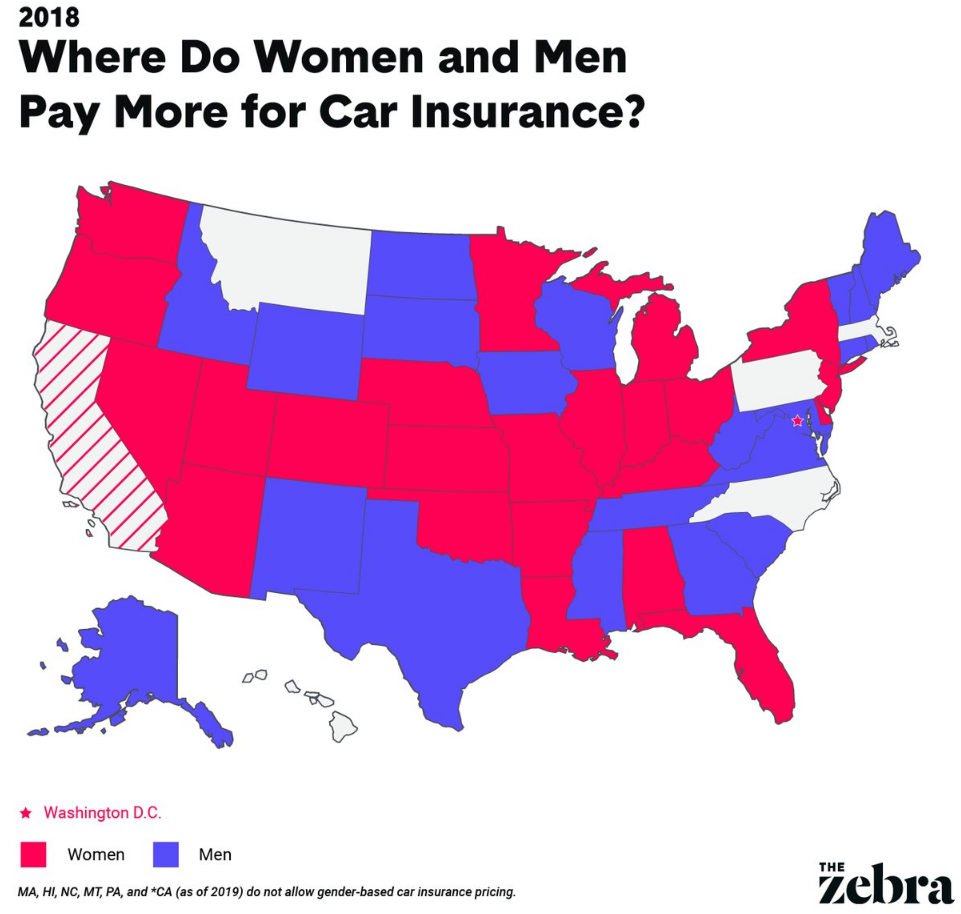

Those of you familiar with the "pink tax" shouldn't be at all that surprised to learn that women tend to pay more than men for car insurance in half of the United States. And this is despite men being found to be the overall riskier drivers. Go figure!

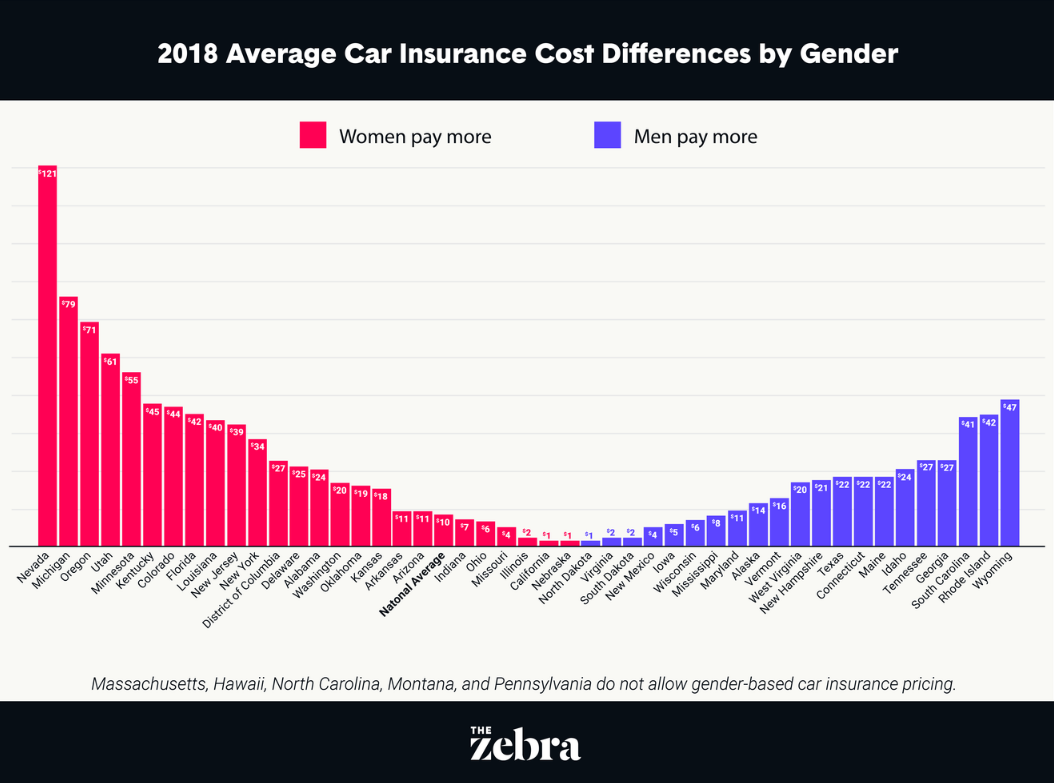

In a new study, an insurance search engine and comparison website called The Zebra found that, on average, women's annual car insurance premiums were about $10 higher than men's last year. Women paid more for car insurance in 25 states, while men paid more in 21.

The states that prohibit gender-based pricing as it applies to car insurance are Hawaii, Massachusetts, Pennsylvania, North Carolina, Montana and, most recently, California. "Gender's relationship to risk of loss no longer appears to be substantial, and the logical justification for the statistical relationship to risk of loss has become suspect," California's department of insurance said.

A higher insurance rate would seem to suggest that companies believe women to be riskier to insure, but these rates don't seem to be largely tied to women being riskier drivers at all. In fact, the Insurance Institute for Highway Safety found in 2017 that more men (71 percent) died in car crashes than women.

And:

Men typically drive more miles than women and more often engage in risky driving practices including not using safety belts, driving while impaired by alcohol, and speeding. Crashes involving male drivers often are more severe than those involving female drivers.

Additionally, The Zebra found:

Men and women engage in distracted driving at the same rates, according to California's Department of Insurance. Insurers in the state identified distracted driving as "one of the primary drivers of increased accident frequency and severity."

In 2017, alcohol-impaired drivers were involved in one-third of all fatal car crashes — and most of those drivers were men. According to NHTSA, there were four male alcohol-impaired drivers involved in fatal crashes for every female alcohol-impaired driver (8,022 versus 1,944).

Speeding was a factor in 28% of male driver deaths and 18% of female driver deaths in 2017, according to IIHS.

While most studies show men more often exhibit in risky driving behaviors, a 2011 study by the University of Michigan showed that women were more likely to be involved in certain types of crashes, especially when turning at intersections.

To obtain these results, the site analyzed 61 million car insurance rates across all U.S. zip codes between September and December of last year and between May and June 2016.

You can try and break down how insurance rates are determined, but it is still largely a mysterious and clouded process that doesn't fully make sense to the average buyer. Maybe using gender helps insurance companies price risk more easily, but it can end up needlessly hurting the consumer.

Click here to read the rest of The Zebra's study!

Update 4:07 p.m. EST: The states where the study found that women pay more than men in 2018 are:

-

New York

-

New Jersey

-

Delaware

-

Washington D.C.

-

Florida

-

Michigan

-

Ohio

-

Kentucky

-

Indiana

-

Illinois

-

Alabama

-

Minnesota

-

Missouri

-

Arkansas

-

Louisiana

-

Nebraska

-

Kansas

-

Oklahoma

-

Colorado

-

Utah

-

Arizona

-

Nevada

-

Oregon

-

Washington

-

California (only banned in 2019)

This story has been updated since publication with a reworded headline.

More on insuring your car from G/O Media's partner:

Jalopnik is not involved in creating these articles but may receive a commission from purchases through its content.

Car Insurance CostsCheap Car Insurance CompaniesBest Car Insurance in 2023Compare Car Insurance Quotes