Why You Should Never Buy Gap Insurance From A Car Dealer

Gap coverage, if you want it, is substantially less expensive when you buy it from your regular insurance company. And yes, they probably offer it.

We may receive a commission on purchases made from links.

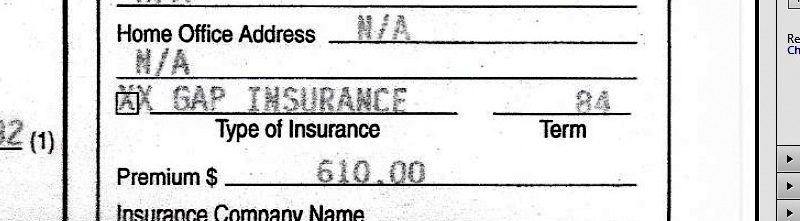

In my practice, I review automobile purchase documents all day long. And I cringe every time I see someone who has purchased the overpriced gap insurance from the dealer. They've been ripped off to the tune of several hundred dollars and probably had no idea.

For those who don't know, a brand new car loses a big chunk of its value the moment you buy it. With the purchase, your vehicle went from being "New" to being "Used" with the stroke of a pen. One more drawback to this is that if your car were to get totaled – say, as you drove it off the lot – your collision coverage will most likely not pay enough on the claim to pay off the underlying loan.

This discrepancy is why one insurance company runs ads about how they are different because they sell policies (to dimwits who name their cars "Brad") which will actually pay replacement value for totaled vehicles. Of course, they are different because most insurance policies promise no such coverage.

As for the typical insurance policy? Go ahead and read yours: It likely says that the company will pay you what it costs to replace your vehicle if your vehicle is totaled. It has nothing to do with what you owe on your car.

And I get that phone call all the time. "I owe $30,000 on my car and the insurance company is saying they will only pay me $22,000!" Yes, apples to oranges. If $22,0000 will buy you a car just like the one you totaled, then you have been made whole under the policy when they pay you that amount.

So, to prevent this scenario from happening, the salesperson at the dealer will tell you how you can buy this great product called gap insurance and all you have to do is pay one lump premium... which they will kindly roll into your loan. Should you ever find yourself in this situation, you will be covered. The gap policy will pay out whatever the difference is between what you owe on the vehicle and what the insurance company is going to pay. (Gap insurance is also sometimes rendered as GAP – with the explanation that it stands for Guaranteed Asset Protection but it is just as likely that it describes the gap between what is owed on the loan and what is paid by the original insurance policy.)

The problem is this: Car dealers sell gap coverage at ridiculously inflated prices. Figures are hard to nail down but dealers routinely charge quadruple what a regular insurance company will charge for the insurance. They then pocket up to one-half of what you pay them for the policy. That's a hefty commission, my friend. Removing that middleman will save you a chunk of money.

Gap coverage, if you want it, is substantially less expensive when you buy it from your regular insurance company. And yes, they probably offer it. In fact, all the insurance company folk who claim I have bashed them in my pieces should send me gift baskets for this one. Call your agent and ask how much the gap coverage will be on your new car. Then ask the salesperson at the dealer for a quote on the dealer's offering. You want to see apples to oranges? Don't be surprised when your agent says he/she can get you the same coverage through your regular insurer for one-third or one-quarter what the dealership offered. And the dealer's coverage will probably not be with an insurer you have dealt with before. Bob's Insurance Shack? Sure – sign me up!

Is gap insurance a good deal? Depends on your aversion to risk and what kind of price you are willing to pay. But that price will almost certainly be lower from your insurance agent than it will be from the auto dealer. Just make the phone call and save your money, if you are inclined to buy it.

More on insuring your car from G/O Media's partner:

Jalopnik is not involved in creating these articles but may receive a commission from purchases through its content.

Gap Insurance GuideBest Car Insurance OptionsCar Insurance TypesHow Much Is Car Insurance?

Follow me on Twitter: @stevelehto

Hear my podcast on iTunes: Lehto's Law

Steve Lehto has been practicing law for 23 years, almost exclusively in consumer protection and Michigan lemon law. He wrote The Lemon Law Bible and Chrysler's Turbine Car: The Rise and Fall of Detroit's Coolest Creation.

This website may supply general information about the law but it is for informational purposes only. This does not create an attorney-client relationship and is not meant to constitute legal advice, so the good news is we're not billing you by the hour for reading this. The bad news is that you shouldn't act upon any of the information without consulting a qualified professional attorney who will, probably, bill you by the hour.