Why Is It So Frustrating To Shop For A Lease?

As Jalopnik's resident car-buying expert and a professional car shopper, I get emails. Lots of emails. I've picked a few of your questions and will try to help out. This week we are discussing why leases are more frustrating to shop for and buying the same car for the same price eleven years later.

First up, why are leases more frustrating to shop for?

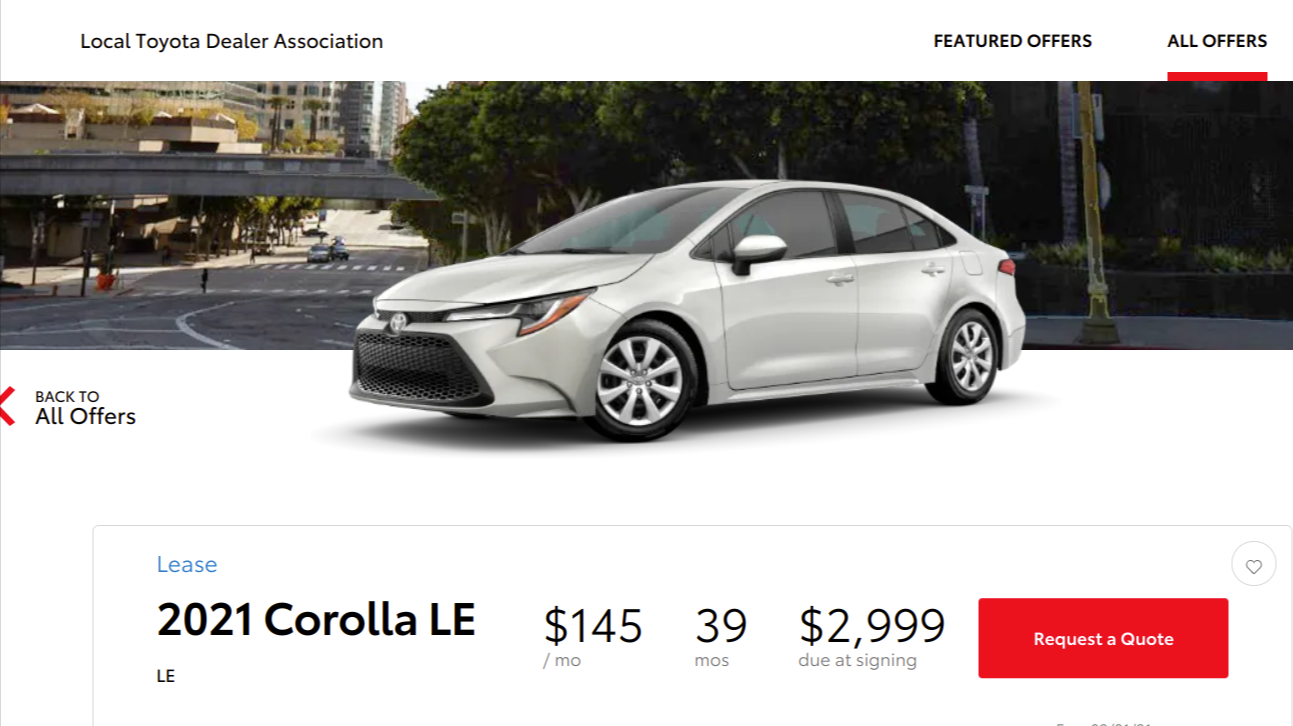

I'm about to lease a car for the first time, and I keep seeing advertisements for vehicles that will work for my budget only to talk to the dealer and the actual payment is much higher. So I don't know what numbers are true. I also see payments for similar cars either much higher or much lower than something with almost the same MSRP. How is that possible?

Unlike purchasing a car, where you can plug your financed amount into a loan calculator and get a fairly accurate number for your payment, calculating leases is a bit more complicated. The main reason is there are more variables that go into a lease calculation, the primary factors are sale price, residual (resale value), and money factor (think of this as an interest rate). Of course, there are also sales tax and documentation fees, but these would also be added into a finance deal as well.

Rather than spend several hundred words on how to shop for a lease I'll point you to a post from way back. What you want to be aware of is that very often the advertised lease specials from a manufacturer or dealer are rarely reflective of reality. This is mostly because the "specials" usually apply only to base models and most folks want cars with more equipment, which means a higher payment. Also, the ads often do not factor in local tax and fees and assume a fairly substantial downpayment. If you are not bringing that much to the table, your payment will increase.

As for why cars with similar MSRPs can have different lease payments this goes back to the primary factors of the sale price, residual, and money factor. Some cars will have better discounts, higher resale values and lower money factors than others resulting in a more competitive lease. This is why it really pays to cross-shop similar cars when leasing because one brand may offer much better lease programs than another.

Next, up, has the Nissan Murano really not changed price in 11 years?

In 2009 we bought a new Nissan Murano SL for 32K. Fast forward 11 yrs later it was time to replace the 2009 Murano and we ended up buying 2020 Murano S for 31K. I was surprised that I bought the new car for less than I bought the 2009 Murano SL. What happened? Did I get screwed back in 2009? Have cars gotten cheaper in the past 11 yrs? I am confused. I don't if I am a idiot or a savy shopper:-) Both cars were bought in florida, the 2009 was purchased in Fort Walton Beach the 2020 was purchased outside of Orlando. Any insight would be appreciated.

The Nissan Murano hasn't maintained its price over almost a decade and the difference comes into the trim levels. You bought an SL trim, which if I remember correctly, was the top of the line model in 2009. The S trim that you recently purchased is a "base" model car. A 2021 Murano SL has a starting price of $41,560 so that is almost a $10,000 jump over your original purchase price in 2009.

Got a car buying conundrum that you need some assistance with? Email me at tom.mcparland@jalopnik.com!