These Are The Absolute Worst Kind Of Dealer Markups

And you thought a $20,000 markup on a 911 GT3 was bad

In this bonkers new car market, prices over MSRP are more common than not. We have numerous posts about dealer markups on various models that will boggle the mind of anyone who is even somewhat rational about car purchases. But the most egregious markups are not on the cars you expect, and this kind of price gouging does the most damage to buyers who need a car versus folks who want a car

Before the automaker supply chain situation went haywire, I had a hot-take that I kept meaning to blog but never got around to it. It was: "Dealer markups only exist because buyers allow it."

The argument was that if every consumer balked at the markup and refused to pay, prices would come down. The blog would have been centered around hot cars like the Civic Type R and Porsche GT series models. The assumption here was that there are enough "normal" cars to go around, allowing for people to shop elsewhere and thus avoiding the markups. I am glad I never wrote that post as it would have not aged well, considering that I have seen "leftover" 2021 Civics sell for several thousand dollars over MSRP.

Honestly, I'm not really mad at dealers who want to sell their 911 GT3 for $20,000 over sticker because for that buyer, that price is "worth it" and when someone is spending $180,000 on a car or $200,000 on a car, the price premium versus its impact on the buyer's lifestyle is minimal. Of course, I am not trying to justify these crazy premiums, but a GT3 buyer can easily choose to just not buy the car if they don't feel the price is warranted and still have plenty of options for personal transportation.

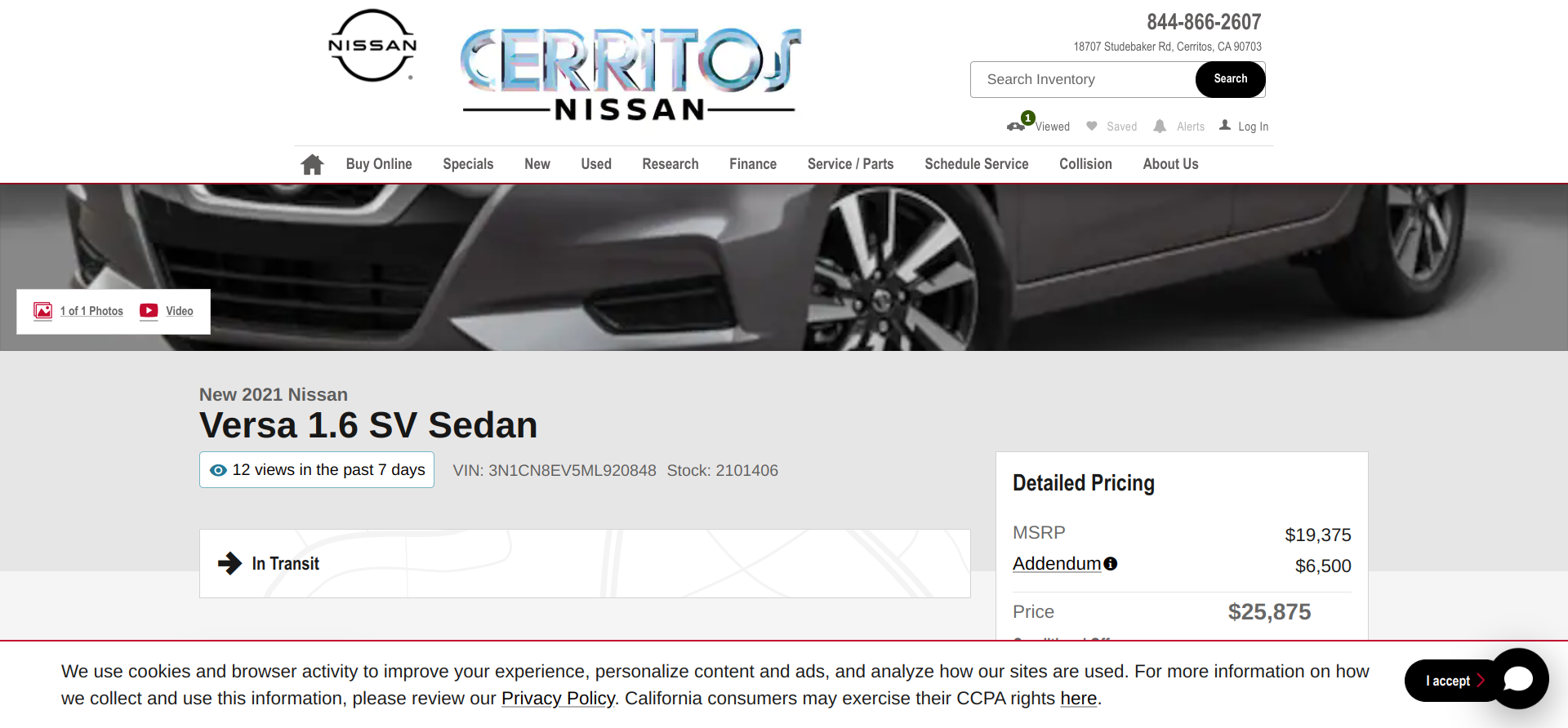

It's the buyers that may not have the choice who are attempting to purchase what should be "affordable" transportation only to run into extreme premiums is where the anger towards dealers should be directed. Take for example this listing for a 2021 Nissan Versa SV with a $6,500 addendum!

That's a 33 percent markup on a car that few consumers would consider "desirable." I'm not saying the Versa is a bad car, but I can't imagine anyone being excited to buy one. This Versa isn't the only example of "cheap" cars going for extreme prices. There are a number of Mirages, Sparks, and other small cars going for well over MSRP.

Let's examine how this markup would really impact the budget for what could be a hypothetical Nissan buyer. The most common loan term right now is for 72 months, and the average APR for someone with a sub 700 FICO is around 6.6 percent.

If a buyer paid the MSRP of 19,375 before tax and fees, the payment would be $327 per month. With this $6,500 markup, the same buyer would pay $437 per month, or an additional $7,992 over the course of the loan. That's a lot of money for someone buying a "budget" car.

The sad reality is that the dude who dropped $20,000 over list price for his GT3 probably isn't really going to "feel" the impact of that extra cost, but I think it's safe to assume that the person who would be buying a $20,000 Nissan is most definitely going to miss that $7,992 over the course of six years.

Now, some folks could make the argument that these people shouldn't be buying new cars anyway and that they would be better served in the used market. Not happening. As my colleague recently pointed out, you can't find cheap used cars anymore either. Sure, they could buy some Craigslist beater for $5,000, but sourcing something of quality is a big challenge, and I can't blame someone for wanting an affordable, reliable car with a warranty to get to work.

(Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to Tom@AutomatchConsulting.com)