The Car Shortage Is About To Get A Whole Lot Worse

A critical element in everything from engines to bodies is in short supply

When you get into your car in the morning, you probably aren't thinking about what materials actually go into its construction. [This is Jalopnik, so a lot of you probably are.—ED] Sure, you might have considered the sheer number of semiconductors powering all the gadgets that come with modern cars, but the actual metal structure of your car likely hasn't had that much of an impact on you.

Now, it may have an impact on the entire industry. A global shortage of magnesium could result in a near-total shutdown of the auto industry — one that experts say could come by the end of this year.

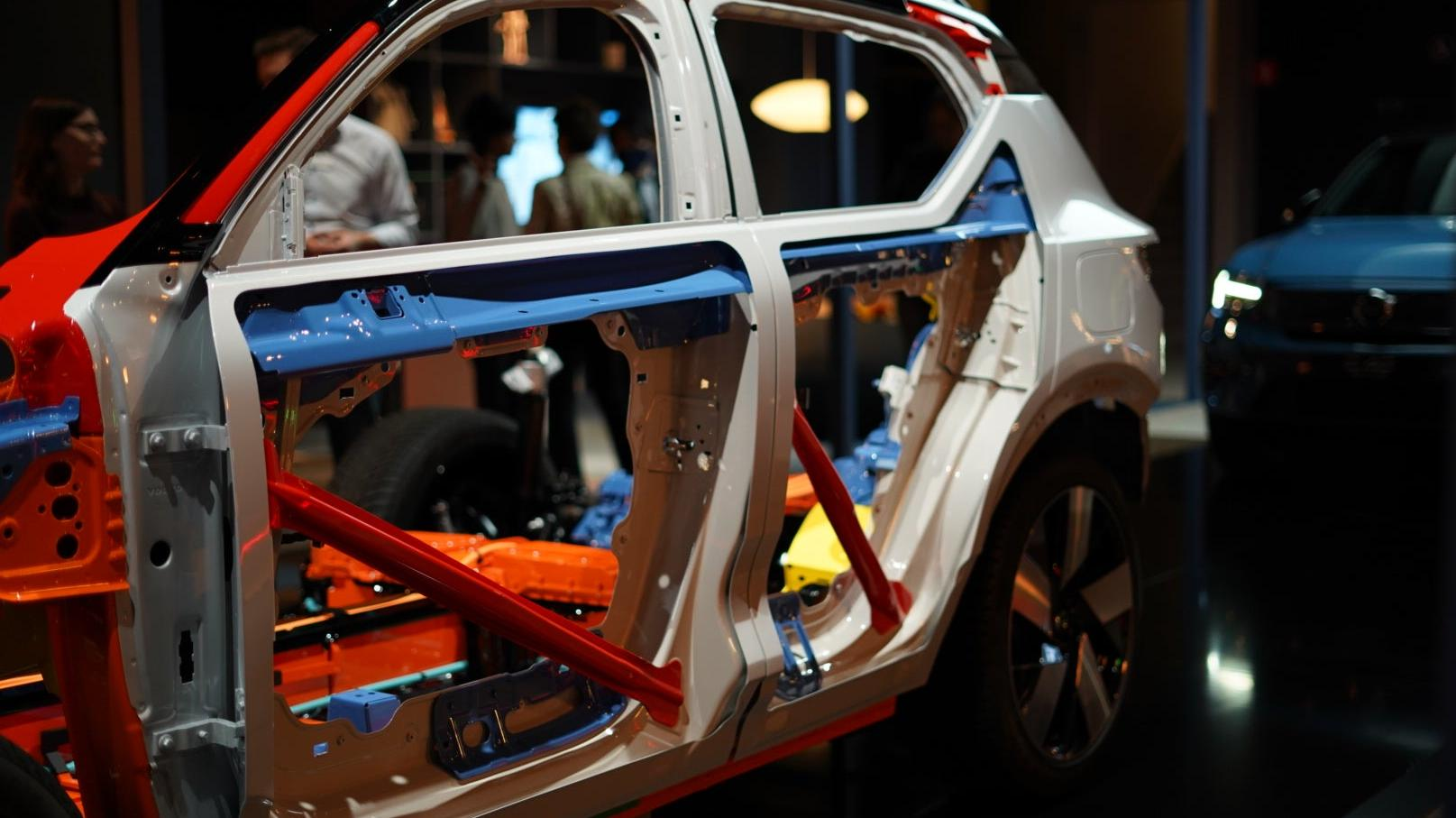

You may not have thought about magnesium since high-school science classes, but it plays a critical role in the automotive industry. Magnesium is used in many aluminum alloys, mainly (at least in auto applications) the 5xxx, 6xxx, and 7xxx-series alloys. These are used in anywhere high strength and low weight are priorities, including:

-

Body panels

-

Fuel tanks

-

Suspension plates

-

Brackets

-

Brakes

-

Engine blocks

-

Crossmembers

-

Axles

-

Impact beams

-

Unibody structures

-

Wheels

Essentially, you can't make cars without aluminum. You can't work with aluminum without using magnesium. And as of December, you may not be able to work with magnesium much — if at all. Amos Fletcher, analyst for Barclays, put it succinctly: "If magnesium supply stops, the entire auto industry will potentially be forced to stop."

China has been in the midst of an energy crisis recently, with factories shutting down to conserve power. Unfortunately for the car industry, China is also the world's primary supplier of magnesium — 85% of the world's supply comes from the country.

The most prevalent magnesium-producing town in China, Yulin, just ordered 35 of its 50 production facilities to shut down. The remaining 15 have been told to scale back operations by half, leaving production drastically reduced.

This slowdown in magnesium wouldn't be such an issue if the metal could be easily stored, but it's got an incredibly short life span on its own. Magnesium oxidizes relatively quickly, and European reserves are expected to run dry by the end of November.

The situation in the US, luckily, is a bit more optimistic. While not nearly on the scale of China, the US is a global producer of magnesium as well. As long as American auto plants can get their hands on enough semiconductors, production shouldn't quite hit a total standstill.

With these shortages piling up, no single mine or factory is likely to immediately fix the new car shortage. We can hope that things will start to improve sooner rather than later, but it's looking like a long, car-free winter ahead.