October's Hottest Selling Used Cars Are Probably Not What You Expected

Pre-owned shoppers are moving away from trucks and SUVs.

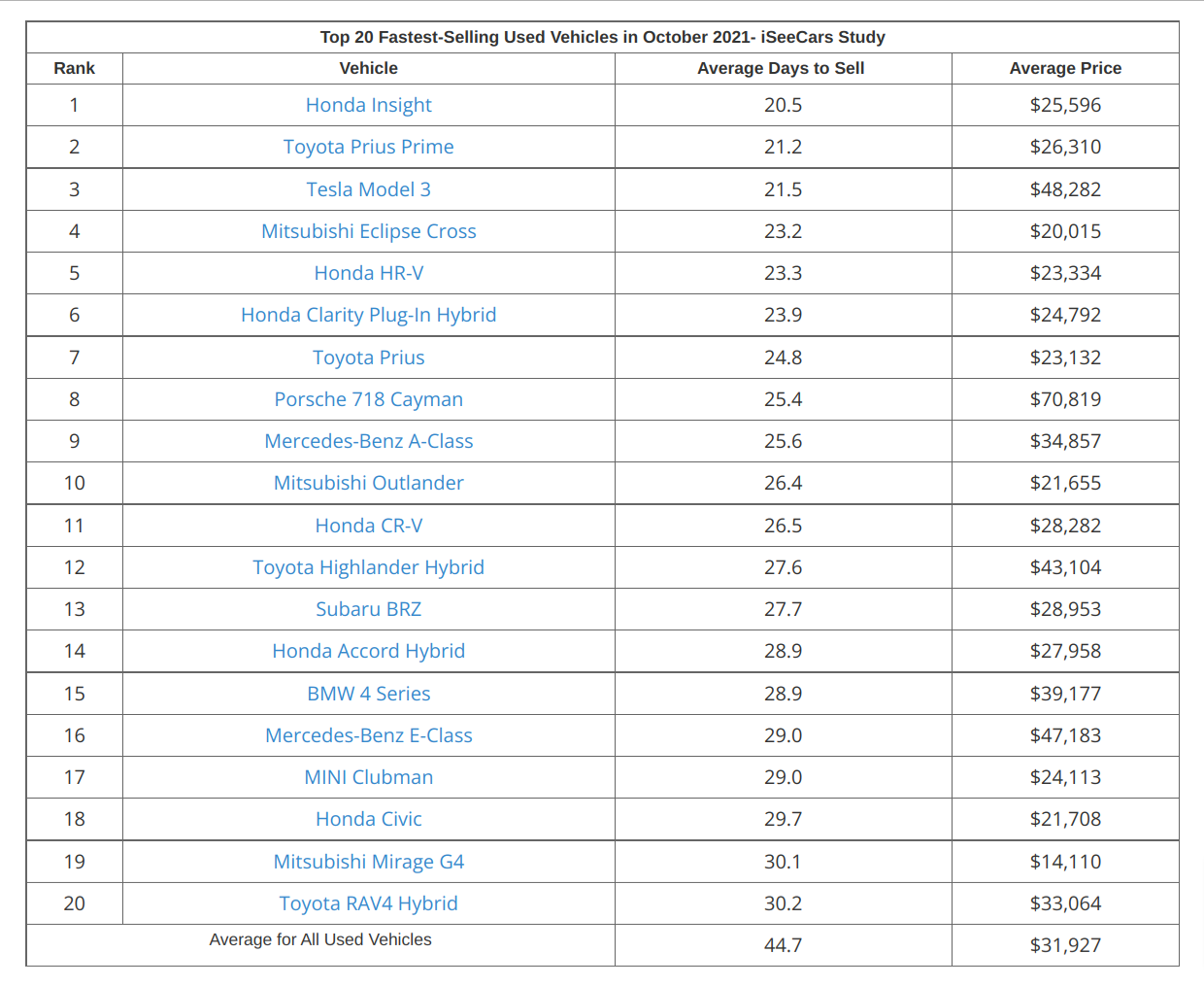

The used car market continues to be challenging for buyers. Prices are still high, and inventory moves fast. According to a recent study from iSeeCars.com, October saw a shift in consumer preferences in pre-owned cars. The fastest-selling models were not trucks and SUVs, but rather vehicles that are more commuter-focused and reduce fuel costs.

Rising fuel costs and more people returning to in-office work may have influenced how consumers are shopping for pre-owned vehicles. While the hottest sellers in the new market tend to be crossovers and SUVs, some new data suggests that used car shoppers are prioritizing practicality and fuel economy.

iSeeCars examined new and used car sales for October using the following methodology:

"iSeeCars.com analyzed over 200,000 new and used car sales (model years 2016-2020 for used cars) from October 2021. The number of days that each car was listed for sale on iSeeCars.com was aggregated at the model level, and the average days on market for each was mathematically modeled. Heavy-duty vehicles, models not in production prior to the 2022 model year, and low-volume models were excluded from further analysis."

As you can see five out of the top ten fastest-selling used cars are either hybrid, plug-in, or full EV. Twelve out of the top twenty models are either compact or sedan. If we included the BRZ and Cayman in that group, 14 out of 20 vehicles on the list are non-crossover/SUVs. And perhaps most shocking is that three out of the top twenty are Mitsubishi models!

While I don't think we are going to see any real reduction in demand for higher-riding vehicles, this October data could be a signal that car buyers are realizing that they don't need a big car and would rather spend less at the pump.

Of course, the depressing part about this data is that the average used car price for each of these models is almost the same as the MSRP for a new model. The Honda Insight has a starting MSRP of $26,225 with destination; the average used price is $25,596. However, given that it's difficult to find a "deal" on a normal car even at MSRP, these used prices could be a bit more palatable for shoppers when compared to new models that are being marked up by several thousands of dollars over the sticker price.