Nine Percent Interest Rates And $8,000 Markups Make This A Bad Time To Buy A New Toyota 4Runner

A markup is always bad. Having to pay thousands of dollars more in interest for over five years is worse

If you're in the market for a new Toyota 4Runner I have some bad news for you: Prepare your finances because you're about to get taken for a ride. Not only do 4Runner buyers have to deal with greedy dealership markups, they're also facing high interest rates if they decide to finance their new SUV.

After what's seemed like an eternity, the first genuinely new Toyota 4Runner in years is finally arriving at dealerships across the country with prices starting at just $120 more than the outgoing generation. Sadly many of those 4Runners are arriving at dealers who are hitting them with some serious markups as CarsDirect pointed out. The largest markup they could find was at a dealer in Costa Mesa, California that has given a new 4Runner a markup of over $8,000.

My own search found another local dealer, this one in Claremont, California, that has an even bigger markup on a 2025 4Runner TRD Sport. Its regular MSRP is $59,713, but a $10,290 markup turns it into a $70,000 SUV. In fact, every single one of the nine 2025 4Runners this dealer has in stock has a markup disguised as "dealer installed accessories." These dealers aren't alone. Of the 800 or so new 4Runners I found for sale, the average markup on them ranged from $6,000-$8,000.

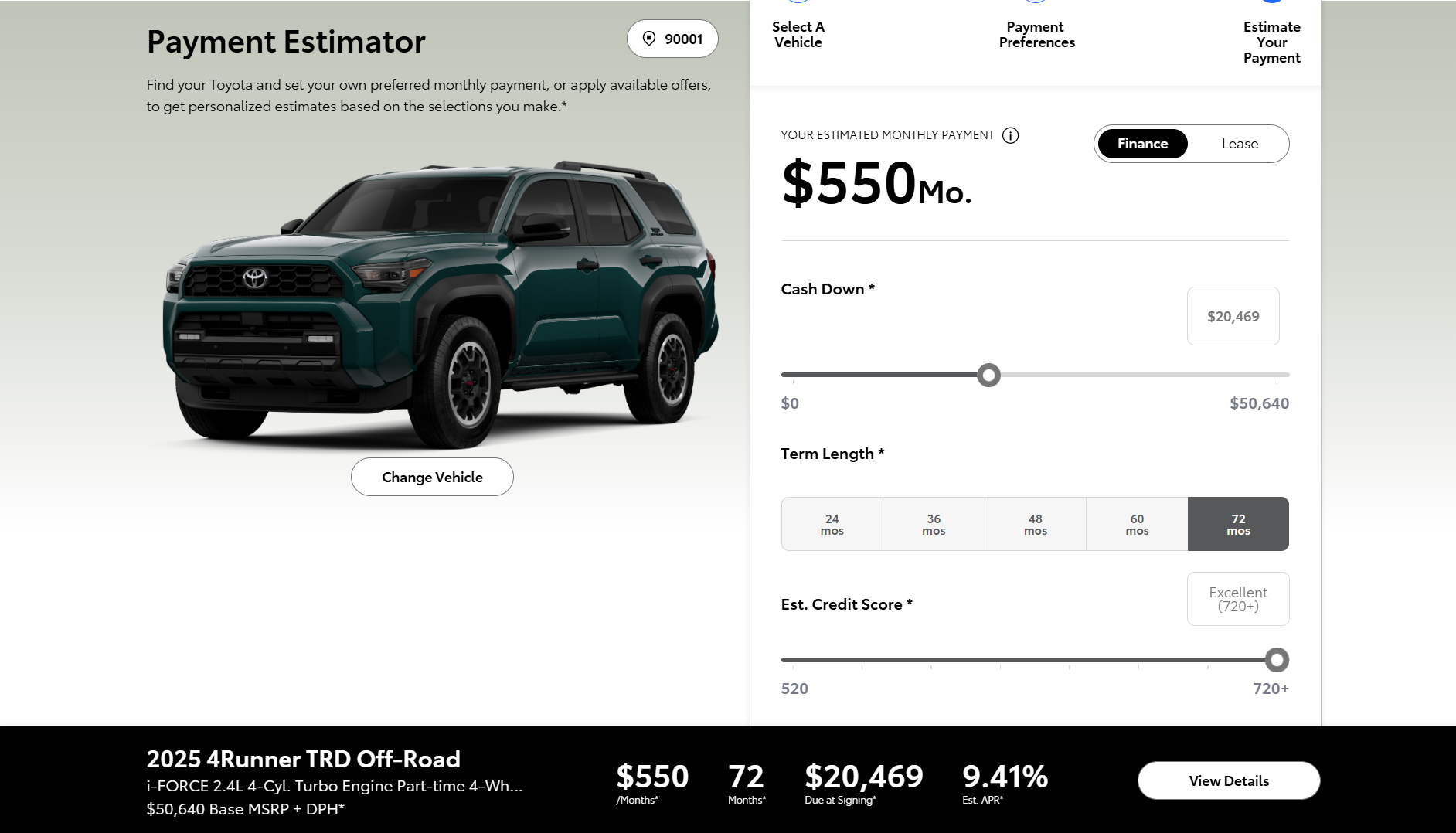

Making this situation worse are high interest rates. Buyers that want to finance their 4Runner through Toyota are going to get hit with interest rates above nine percent, and that's for prime credit buyers. If you use Toyota's payment estimator tool, you'll find that the APR defaults to 9.02 percent for buyers with credit scores of over 720. Those rates can get worse with lower credit scores. Someone with a credit score of 650-669 will get hit with a 12.82 percent interest rate if they finance a 2025 4Runner TRD Off-Road for 60 months; that rate jumps to 13.28 if the buyer goes for a 72-month term. Any way you go about it, that's thousands more in interest.

If these rates are too much — and they are — interested customers might find a better buy in the mechanically similar Tacoma, as Cars Direct pointed out:

On a 72-month loan, the 2025 Tacoma can be financed at just 5.99% APR. As a result, a $45,000 Tacoma could cost over $5,300 less than a $45,000 4Runner.

None of this is new to the 4Runner. The outgoing generation of the SUV was still getting hit with markups right up until the end. Previous versions of the 4Runner TRD Pro and TRD Off-Road were priced in the high $70,000-to-low-$80,000 range in some places because of markups.

If you just have to have a new 4Runner, go for it. It's a free country. Just know you're getting into a questionable financial situation given the combo of rates and markups. Or you could take my advice and wait until the market cools down. You'll be financially better in the long run if you do.