Most Car Buyers Are Ready For Autonomy: Report

Consumers are ready to jump behind the wheel of an autonomous vehicle, Europe is hunkering down on EV research, and, yes—there's tariff news. All this and more in The Morning Shift for Thursday, May 16, 2019.

1st: Car Buyers Want Autonomy Now

"Autonomy" has been one of the more recent buzz words in the auto industry as manufacturers like Tesla and Cadillac delving into the research necessary to reduce driver input and let the car do most of the work. But how many people actually want that?

A slim majority, according to a study published by the Capgemini Research Institute. In a survey of 5,500 consumers and 280 automotive executives, 59 percent of people said they would wholeheartedly embrace our autonomous future. Consumers have full faith that automakers will sell them a safe and reliable product—but the automakers themselves are skeptical about overcoming the current obstacles.

Per Automotive News:

"It's not just safety and the technical aspects of autonomous cars that will determine their adoption rate — it's also the consumer experience," Markus Winkler, the director of the global automotive sector at Capgemini, said in an interview.

Winkler said that engineers and researchers needed to work hand-in-hand with marketers and user-experience experts to create self-driving cars that serve customers' needs. "The consumer has to be brought back into the boat of this discussion," he said. "They expect to be safely transported, but they also expect the convenience and the customer experience that autonomous driving is promising them."

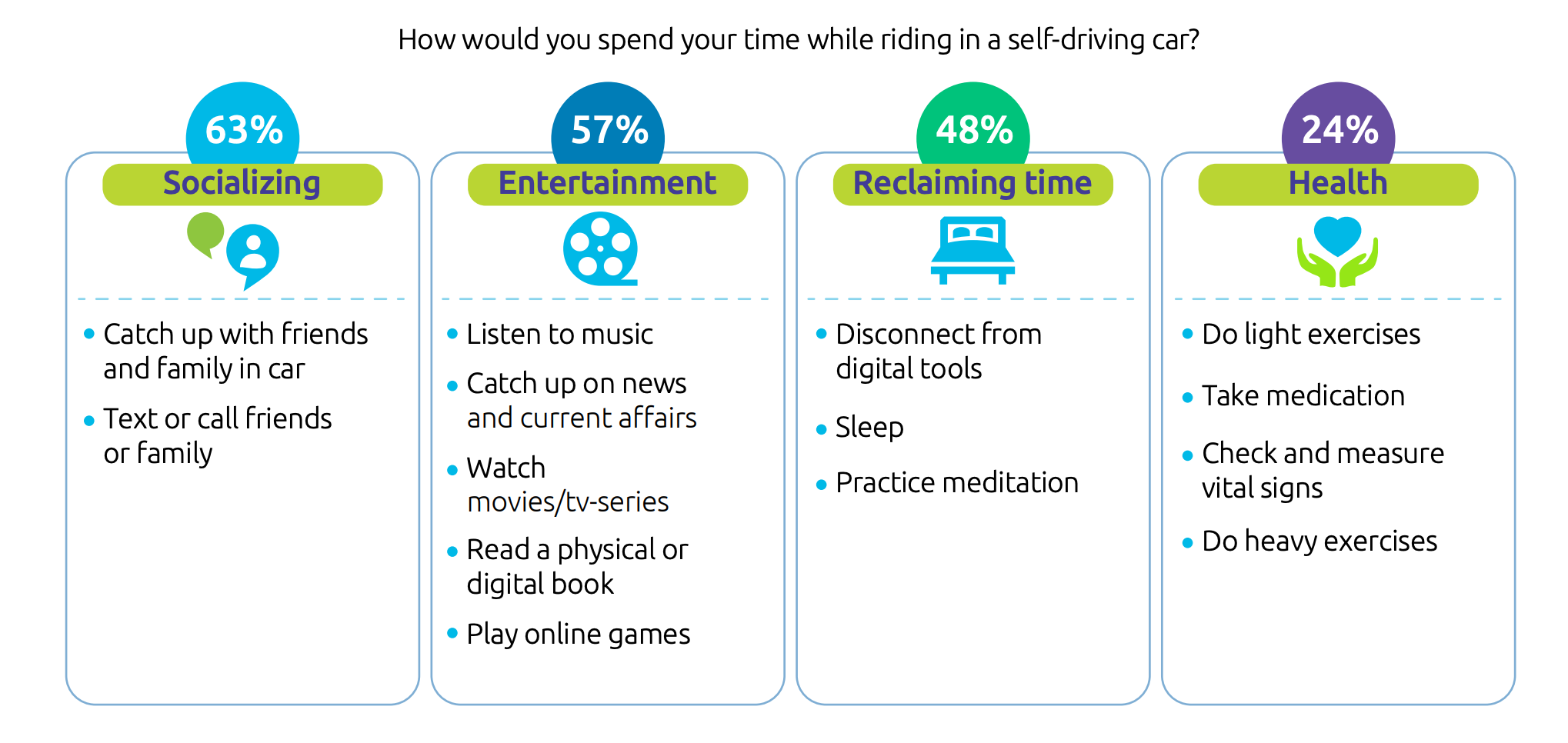

So, what do these consumers plan on doing behind the wheel of their self-driving car? A whopping 63 percent of the people who are ready to embrace autonomy say they'd use the time for socializing with friends. Another 48 percent said they'd use it to sleep, meditate or just unplug after a long day.

If you've been following along with the self-driving car news, you'll know that this study comes at a pretty crucial moment. Ford CEO Jim Hackett has admitted that autonomy has been overhyped, and companies like Tesla and Waymo have been in the news for self-driving crashes. This study shows that there's still a decently sized interest in autonomy—but it has to be done right.

However, this study could be reflecting consumers' common misconceptions about autonomy. Self-driving cars are still in their infancy and even models with advanced autonomous features require humans to stay alert and focused on the road. We're still a long way from sleeping or watching TV from behind the wheel.

If you're interested in reading the full in-depth report by Capgemini, you can find it here.

2nd: No One Wants a Burning Battery

As it turns out, not all press is good press. Tesla's recent spate of battery fires are sounding the alarm about the safety of electric cars. No one wants their mode of transportation to catch on fire—and the fact that some batteries have been doing so could be having a negative impact on the desire to go electric.

From Bloomberg:

"Battery combustion is a very serious incident for consumers, and it could lead to consumer aversion to electric vehicles," Automotive Energy Supply Corp., whose batteries power about 430,000 Nissan Motor Co. vehicles, said in an email. "We are determined not to cause serious accidents and put damage on the industry, and we believe that now it is more important to proceed with caution."

There's reason to be worried. Should Chinese consumers slow their shift to plugins because of safety worries, it would be a serious blow since the nation accounts for more than half of all electric-passenger car sales worldwide. While China is forecast to remain the largest market for the next two decades, sales are already slowing and growth will probably continue decelerating until 2021 as the government phases out subsidies, according to BloombergNEF.

Like anything in the automotive industry, rapid growth often leads to an increase in quality control issues. We want our cars to be safe, but automakers will sometimes build fast and cheap to keep up with demand both from consumers and shareholders. But the more problems that start showing up, the less people are going to want to invest in the product.

3rd: We’ve Got Trump Tariff Updates

Yes, there's always more—and we have some good and bad news.

The bad: It turns out that European and Japanese auto makers aren't getting off quite as easy as they might have thought. More from Bloomberg:

The U.S. president is poised to give the EU and Japan 180 days to agree to a deal that would "limit or restrict" imports into the U.S. of automobiles and their parts, according to a draft executive order seen by Bloomberg. The problem is that Trump's plan concludes that car imports do in fact constitute a national-security threat, and what he's seeking in return for a tariff reprieve may not fly.

World Trade Organization rules prohibit any voluntary export restraints. The European Union, and especially countries like France, says it opposes any deal with the U.S. that would violate WTO rules and the international rules-based order.

Optimists may hope that European powers which are most keen to avoid car tariffs, such as Germany, could convince the bloc to turn a blind eye to potential WTO violations with export restrictions. The bloc was ready to accept a fudged deal of this kind last year, when Trump threatened the EU with punitive tariffs on steel and aluminum.

In a last-ditch attempt to avoid the levies, the EU signaled it was willing to tolerate quotas. This means that it wouldn't legally challenge or retaliate potential tariffs on steel and aluminum, as long as these were imposed after a certain volume of exports.

In practice, what Trump was demanding and what the EU was willing to tolerate proved impossible to reconcile. U.S. tariffs on steel and aluminum were eventually imposed, and the EU retaliated with duties on a long list of U.S. goods ranging from motorcycles to bourbon.

Basically, Trump and most of the rest of the world are butting heads about the U.S. President's liberal attitude toward imposing tariffs whenever he pleases. For more details, check out the full report on Bloomberg.

There is some good news, though, especially for the auto industry. The U.S., Canada, and Mexico are nearing a deal regarding the removing of steel and aluminum tariffs. From Automotive News:

"I think we are close to an understanding with Mexico and Canada" on removing steel and aluminum tariffs, [Treasury Secretary Steven] Mnuchin told a Senate Appropriations subcommittee hearing on Wednesday morning. U.S. Trade Representative Robert Lighthizer is in "active discussions" over the issue, he said.

Senate Finance Committee Chairman Chuck Grassley, an Iowa Republican, has said he would block ratification of Trump's revision of the North American Free Trade Agreement, called the U.S.-Mexico-Canada Agreement, until the metals tariffs are lifted on the U.S. neighbors. Both Canada and Mexico have imposed their own tariffs on American agricultural exports and other goods in retaliation for the levies.

U.S. officials have insisted they will only lift the tariffs if Canada and Mexico accept quotas or other mechanisms that would avoid them becoming a conduit for cheap steel entering the U.S. from other countries including China. Both Canada and Mexico have so far resisted such a plan.

4th: Ford to Build Cars Locally for the Chinese Market

Ford hasn't been doing so hot over in China lately—the operation is losing more money than it's worth. But a new plan to start building Chinese-market cars in China proper aims to compensate for some of the company's losses. Namely, Ford will be manufacturing Lincoln models locally later this year.

More from Bloomberg:

The automaker has struggled with an aging product line in China, losing $128 million there in the first quarter as sales plunged by 36%. Reversing its slide in the world's largest auto market is key to Chief Executive Officer Jim Hackett's $11 billion restructuring of the company. Lincoln has been the lone bright spot for Ford in the market, where it sold a record 55,315 of its luxury models last year, as sales of the jumbo Navigator SUV soared 84%.

[...]

Local production would avoid [Trump's] tariffs, but automakers with plants there could still face retaliation from the government or a stiff arm from consumers if relations worsen.

It's a positive sign for Ford as a company. It'll be interesting to compare revenue after the production location swap.

5th: Europe Pivots to EV Research

As interest in electric vehicles rise, so must the research that makes this new technology possible and efficient—and Europe is getting on board with the idea of a more eco-friendly future.

China's Geely Auto has just opened a research and development center in Raunheim, Germany, Automotive News Europe reports. The intention here is to develop EVs and other mobility solutions for the future. Geely is looking to hire 300 engineers in all disciplines to create the cars of the future.

Meanwhile, the UK government has pledged 28 million pounds ($36 million) to establish an "industry-leading" facility to research the development of batteries, per Automotive News Europe—and it has a multi-faceted goal.

The project is part of a broader aim for Britain to build a so-called Gigafactory — a large-scale battery factory that would cater for car companies that build in Britain, including Jaguar Land Rover and Nissan.

Development of EVs is also a crucial component of Britain's plan to slash greenhouse gases.

For the government, there is a wider problem of retaining automakers as uncertainty created by Brexit undermines production lines.

Neutral: Are You Ready for Autonomy?

If you're a huge car enthusiast, chances are you're not keen on the whole idea of giving up your control as a driver. But would you mind giving up some of those freedoms in favor of getting more shit done on your commute?