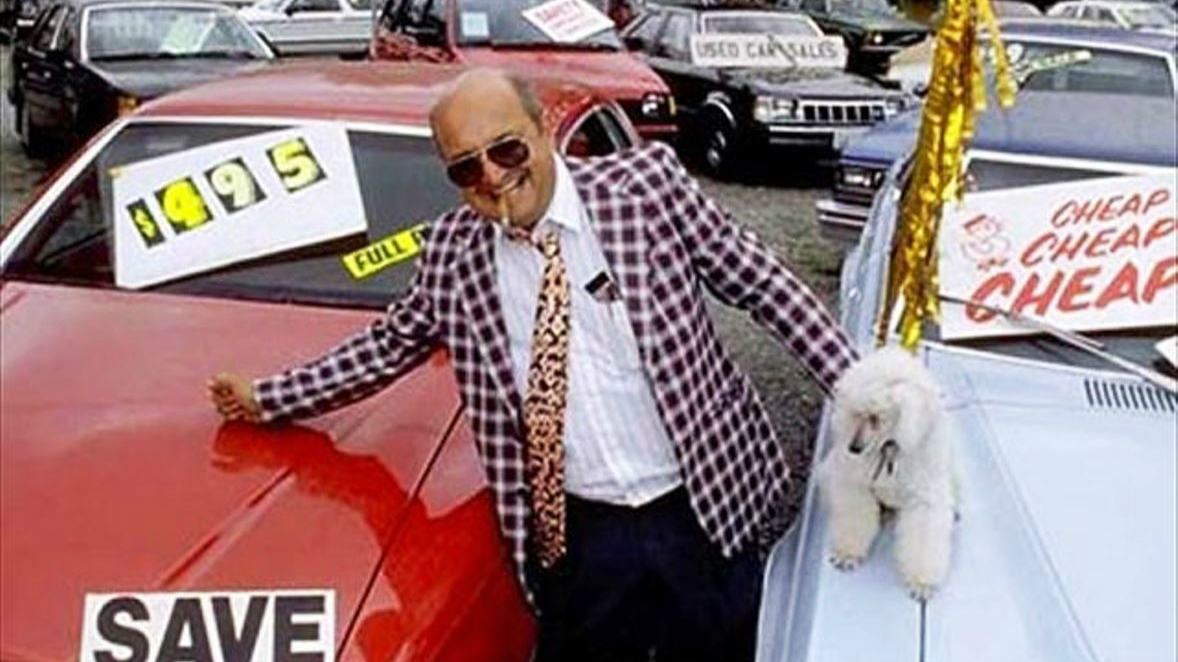

Here Are The Most Common Illegal Things Car Dealerships Will Try To Do

Buying a car from a dealer isn't nearly as bad as it used to be. Unfortunately, there are still some stores that care more about profit than happy customers and will even go so far as to do some unscrupulous and even illegal activity to make a buck. Here are some of the worst things you should be on the lookout for.

As a professional car shopper, it's my job to find the best price at a dealership that hopefully offers a less stressful experience than most places. Often I will encounter dealers who are not very cooperative or professional and I filter them out of the process. Unfortunately, a lot of folks end up at the wrong dealer and with a bad deal and sometimes this requires some legal intervention to get the dealers to do the right thing.

I spoke with two consumer protection attorneys who represent various customers, taking scummy dealers to court when those places have violated consumer protection clauses, finance, advertising, and contract laws.

Steve Lehto is a consumer protection attorney operating in Michigan and has been a contributing writer for automotive outlets like Jalopnik and Road and Track, he also runs a regular podcast called Lehto's Law.

Steve says that consumers need to watch out for dealers that do the following -

Dealers that curbstone. They have a hard time moving the car off their lot so they advertise it on craigslist and pretend it is a private sale. (This may be legal in some states but it certainly is shady). The key? Beware of a private seller claiming they have a dealer doing the paperwork as a favor.

Dealers that don't pay off trade ins (when they have agreed to do so to make a sale). I've heard of dealers dragging their feet and of the occasional dealer that never paid it off. The key is to follow up quickly and be wary of dealing with smaller, lesser-known car lots when it comes to a deal like this.

Dealers selling cars they don't have the titles to yet. Again, varies by state, but I'd be wary of buying a car from anyone without seeing the title first. Among other things, the color of the title is often a flag to let you know if the car has a normal title or not (like a salvage title).

Dealers that make money vanish. As in, you put money down on a car before paperwork is finalized and somehow, the numbers on the final deal are such that the down payment got swallowed somewhere. No money should ever change hands before you have in writing the exact numbers on the deal.

In addition to Steve, I also got in contact with Daniel Whitney, Jr. of the law firm Whitney, LLP. He operates primarily in Maryland, but other lawyers in his firm operate in the surrounding states as well.

Daniel also writes articles and makes videos to show how consumers can protect themselves. He gave me a deep dive on some more finance and contract oriented fraud on the part of dealerships.

There is no shortage of illegal activity from car dealers. In my seven years of representing consumers, I have seen a wide variety of illegal behavior from both new and used car sellers.

Inflating income and deflating monthly rent on the credit application.

Finance managers are notorious for inflating income so a consumer will qualify for a car that they cannot afford. At the same time, they decrease the consumer's monthly rent for the same reason. I have seen many consumers with credit applications that say they pay no rent because they "live with family," who also are stated as making double or triple their actual monthly salary.

If credit application fraud happens to you, call an experienced auto fraud lawyer. Often times, bringing this to the attention of a dealership will be met with a shrug of the shoulders and offer of a free car wash. These claims are worth much more, but it usually takes hiring an attorney to maximize the value.

Forging customer signatures on Retail Installment Sales Contracts and Lease Agreements.

Although forging signatures on financial documents that are submitted to banks means committing a variety of felony state and federal crimes, this happens all the time. The forged document, if it is a Retail Installment Sales Contract (RISC), usually has a decreased interest rate and an increased amount financed. A smart finance manager will play with these numbers so the monthly payment remains the same despite the dealership taking additional profit. Or, they will stretch out the payments by another six months to allow for the additional stolen profit.

There are several ways to detect forgery and fraud on the RISC and Lease Agreement. First, if the monthly payment on the car payment bill from the bank is off by even a penny, that likely means that the customer's signature was forged. Second, if you have a credit monitoring application like Credit Karma, Credit Wise, or another one that alerts you to balances on your credit report, make sure the balance is what you agreed to. Third, and the best way, is to simply call the finance company and request a copy of the RISC or Lease Agreement sent to them by the dealership. They usually fax or email it within a day or two. Compare the copy you were given at the dealership with what you were sent by the finance company. If they forged your signature, you now have serious legal rights.

If you this type of forgery and fraud happened to you, you can try to negotiate a settlement directly with the dealership, but if you do, aim high. They will pretend it is not a big deal, and maybe offer a few thousand dollars. These cases have significant value into the tens of thousands of dollars, and it may take hiring an experienced auto fraud attorney to get it.

Representing vehicles as having no accidents when they do have serious damage.

In Maryland, like many other states, the law prohibits dealerships from committing fraud in order to sell a car. It also prevents them from making material misrepresentations to sell a car. This misleading behavior often takes place when a car is advertised as being "clean" and having no accidents. Many, many consumers have contacted my office within a week or two of having bought a used car that was advertised as such, and instead have discovered serious damage and engine problems after they drove it for a week, took it to a mechanic due to problems that started, and then discovered the extent of the problems and realized they had been lied to.

When this happens, as soon as you realize you were lied to, make sure to capture a screen shot of the advertisement of the car if it was advertised online, and use that to address the issue with the dealership. If they refuse to accept the car back or provide repairs, the next step is to file a complaint with your state's Motor Vehicle Association (MVA). Posting a review about your unpleasant experience may also provide the leverage you need to return the car or get the repairs done.

The best way to avoid this is something that I tell my clients, friends and family all the time. Before you buy a used car, even a Certified Pre-Owned car, HAVE A TRUSTED MECHANIC PERFORM A PRE-SALE INSPECTION.

Spot Delivery Violations and Yo-Yo Sales

When a car dealership delivers a car to a consumer, but the financing has not been finalized, most states require that information to be provided to the consumer so they know the deal is not final.

If this happens to you, first try to get all of your money back from the dealership. Second, contact an experienced auto fraud attorney to bring a claim against the dealership for the violation of the law. You may be able to recover both any economic losses as well as emotional distress, which can be significant, depending on the facts. Third, file a complaint with the MVA, and consider leaving an online review to warn other consumers of the illegal practice.

The dealership steals the GAP and/or extended warranty money.

The fraud here is simple. The customer pays for GAP and an extended warranty, but the dealership never pays the premiums. The fraud comes to light when either an accident occurs, and the customer wants to make a GAP claim, or there is a mechanical issue and the customer makes a warranty claim. The customer then finds out that no premium was ever received. This usually sets off a months-long rabbit hole of the customer trying to contact the dealership, leaving messages, not getting called back, and generally getting extremely frustrated from being ignored and of course because they have a serious problem with their vehicle.

If the GAP insurance was not paid and there was an accident, inform the finance company and the GAP insurance company of what happened, and provide them with your paperwork showing that you paid for the coverage. Sometimes they will step in and do the right thing, and deal with the dishonest dealership later.

Also, file an MVA complaint right away. The process with the MVA can take over a month, so you want to get it going. Make sure to contact an experienced auto fraud attorney who should be able to get things moving faster for you on the civil litigation side of the case. In a fraud case like this, the customer should be able to recover not only compensation for the damage or repair that should have been recovered, but may also recover compensation for emotional distress due to the fraud.

Both Steve and Daniel recommend that if you feel you have been ripped off and you think the dealer has acted illegally in regards to the financing, contract, or any other aspect of the sale to find a local consumer protection attorney. Most legit lawyers will give you a free consult and take their fees from the settlement of the case, not from the consumer.

That being said, the best cure is prevention. Your best defense against shady dealer practices is to understand your budget, do your research, and be diligent about not only getting prices but reading and understanding the contracts at the time of sale.