Widespread Automotive Production Halt Just A Week Away Due Of Tariffs

Good morning! It's Friday, March 14, 2025, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. This is where you'll find the most important stories that are shaping the way Americans drive and get around.

In this morning's edition, we're taking a look at what Trump's tariff war could do to the auto industry in the coming weeks as well as a re-introduced House bill that'll get rid of the so-called "EV Mandate." We're also going to check out how much money these tariffs could cost BMW in 2025 and why Ford CEO Jim Farley made less money in 2024 than in 2023.

It's another busy day, so buckle up.

1st Gear: Global production disruptions are a week away

There's a high likelihood that in just one week the global automotive industry could experience an extended disruption period because of the ongoing global tariff war. In this scenario, several vehicle models would cease production, new vehicle processes would rise and product development could impact production for years to come, according to a study from S&P Global Mobility. We could actually see production dropping by a staggering 20,000 vehicles per day.

At the very least, that's one of three scenarios the firm laid out after analyzing the impact of the uncertainty and volatility caused by President Donald Trump and his drastic change to tariff policy. S&P gives this scenario a 50 percent chance of actually happening. As it turns out, antagonizing your trade partners and going back and forth between implementing and repealing tariffs is not a winning strategy. Who knew? From the Detroit Free Press:

S&P Global Mobility rates the chance of a quick resolution scenario to tariffs at a mere 30% likelihood, given the recent state of affairs and ongoing fits and starts to the tariff war.

Given that most carmakers and their suppliers will invest capital only if there is long-term stability in the trade and planning environment, the ongoing uncertainty may delay development of future vehicle programs, especially with uncertainty around emission and fuel economy regulations, S&P Global stated.

[...]

"With tariffs now imposed on Canada and Mexico, we expect significant disruption in the region. S&P Global Mobility sees potential for North American production to drop by up 20,000 units per day within a week," the report stated. "We now expect that the tariff posture, messaging and coverage through 2025 will be erratic, placing (automakers) and suppliers' mid- or long-term vehicle and facility planning in a virtual gridlock."

S&P has laid out three scenarios for how all of this will shake out. Two of them are rather bleak. In the best-case scenario, with the 25 percent tariffs on Mexico and Canada in place and delayed tariffs for U.S.-Mexican-Canada-Agreement-compliant products, the firm sees a 30 percent probability of a quick resolution. That could still take up to a month. During this, some automakers will lose production and there will be border gridlock. In this scenario, lost sales and production can be made up for.

Unfortunately, this is the best-case scenario. Next up, we've got that 50 percent probability scenario we spoke about before. It would mean the tariffs last 16 to 20 weeks and during this time "several high-exposure vehicles will slow or cease production," according to S&P's study. Consumers would see limited incentives as automakers struggle to protect profits.

Finally, we've got the nuclear scenario: a "tariff winter." Here's what would happen in that scenario, explained by Freep:

The most dire scenario is a "tariff winter," which S&P Global Mobility places at a 20% probability. In this scenario, it said that "25% tariffs on Mexico and Canada are integrated long-term into auto trading and any resourcing from Mexico or Canada to the U.S. resulting from the high tariffs would create an environment of suboptimal sourcing, as vehicles and components currently produced in Mexico and Canada are currently in those locations due to cost and efficiency advantages." To move them to the U.S. ends those advantages and raises costs, but leaving them where they are also increases costs because of the tariff.

In the last scenario, S&P Global said moving production to the U.S. to avoid tariffs could raise labor costs for manufacturing, worsen a general labor shortage and leave car companies and suppliers with underutilized plants in Mexico or Canada.

We're all so boned, man. Hold on to your butts, because judging by society's luck lately, option three seems like it could really happen.

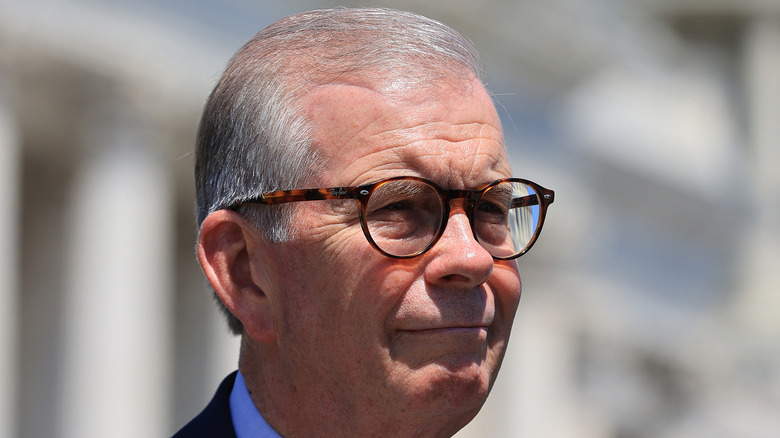

2nd Gear: Republicans are still after the EV mandate

Republican U.S. Representative and guy who doesn't know how anything works, Tim Walberg, is planning to reintroduce legislation that will ban the federal government from issuing rules that mandate electric vehicle sales or limit the availability of gas-powered cars. The Michigan lawmaker introduced a similar bill — called the Choice in Automobile Retail Sales (CARS) Act — in July of 2023. It passed in the U.S. House along party lines in December of that year, but it never got a full vote in the Democart-controlled Senate.

It's also a bit pointless because no one in the federal government has advocated limiting the availability of gas cars. Sure, the Biden Administration wanted automakers to do more to clean up their tailpipe emissions, but that doesn't mean gas cars wouldn't be available anymore. That sort of stuff doesn't matter when you're a politician looking to score points with your conservative base, though. Anyway, here's more from the Detroit News:

"Americans need access to reliable, affordable, and functional forms of transportation," Walberg said in a Thursday statement. "The CARS Act will ensure that consumers have the freedom to decide what car works best for them and their families."

[...]

Walberg and other Republicans, including President Donald Trump, have said [Biden's] efforts amounted to an EV mandate that will harm businesses and push consumers to adopt a product they don't want.

"To provide some stability for the industry, we must prevent future unrealistic government mandates like the ones we saw under the Biden administration," Walberg said. "The future of the automotive industry should be driven by engineers in Detroit, not by bureaucrats in Washington. Our bill will put American consumers back in the driver's seat."

The bill, which is apparently nearly identical to the one he proposed in 2023, is meant to amend the Clean Air Act to prohibit and federal regulations that "mandate the use of any specific technology" or "result in limited availability of new motor vehicles based on the type of new motor vehicle engine in such new motor vehicles." My God, we live in the stupidest timeline imaginable.

3rd Gear: BMW expects 1 billion euro hit over tariffs

BMW is laying out just how badly the tariff fight between the U.S., Europe and China is going to hurt business. CEO Oliver Zipse says the conflict is going to cost the German automaker about 1 billion euros ($1.1 billion) in 2025. He did mention that he doesn't think many of the tariffs will last terribly long, though, adding "We are quite safe." From Bloomberg:

BMW and other European carmakers are bracing to see the full extent of President Donald Trump's planned tariffs on vehicles imported to the US. The levies threaten to hit not just cars made in Europe but also those produced at plants in Mexico and Canada, which automakers have operated for years under previous trade agreements.

BMW is already facing duties on vehicles it produces at its plant in San Luis Potosi, Mexico, for export to the US. Trump has postponed the tariffs for companies in compliance with the USMCA trade deal, but BMW falls short of local content rules.

At the same time, BMW is being hit by European Union tariffs on vehicles imported from China, where its Mini brand produces an electric car and an SUV. BMW has joined Chinese manufacturers in challenging the levies in court.

If you think for a second these higher costs aren't going to be passed along to the customer in one way or another, buddy, I've got a beautiful bridge to sell you.

This whole tariff mess is just a masterful gambit by President Trump. It really is.

4th Gear: Ford quality issues cost CEO Farley millions

Ford CEO Jim Farley is going to have to make do with a few million fewer dollars because the automaker failed to hit a number of performance objectives — most notably its quality improvement targets. In 2024, Farley's total executive compensation was $24,861,866. That's an absurd sum of money, but it is technically less than the $26,470,033 he raked in in 2023, according to documents filed with the U.S. Securities and Exchange Commission. Here's more from the Detroit Free Press:

Ford disclosed that it came up short in its annual performance bonus metrics. The targets in that metric consist of meeting board goals for pretax adjusted earnings before interest and taxes, global electric vehicle sales volumes, connected services, year-over-year revenue growth and quality.

"Our overall achievement against the targets set for our 2024 Annual Performance Bonus Plan yielded a business performance factor of 69%. This result was largely driven by challenges in the quality metric," the filing stated. "The Committee believes the final 2024 payouts for the Named Executives are consistent with the performance-based nature of the Annual Performance Bonus Plan, holding executives accountable for and emphasizing the importance of both their individual performance and the performance of the Company."

Farley's total compensation was comprised of a $1.7 million base salary, $20.7 million in stock awards (a $400,000 uptick from 2023), about $1.6 million in incentive plan compensation (down from $2.4 million in 2023) and a tick under $900,000 in payments for things like vehicles and life insurance/death benefits.

In what is nearly some good news for employees, Farley's total compensation to the median of the annual total compensation of all employees fell to an eye-watering 253-to-1. That's somehow a decline from the 312-to-1 in 2023 and the lowest ratio in three years. Part of that is because the median annual total compensation for all employees other than Farley rose from $84,829 to $98,273. You can thank the United Auto Workers union for that.

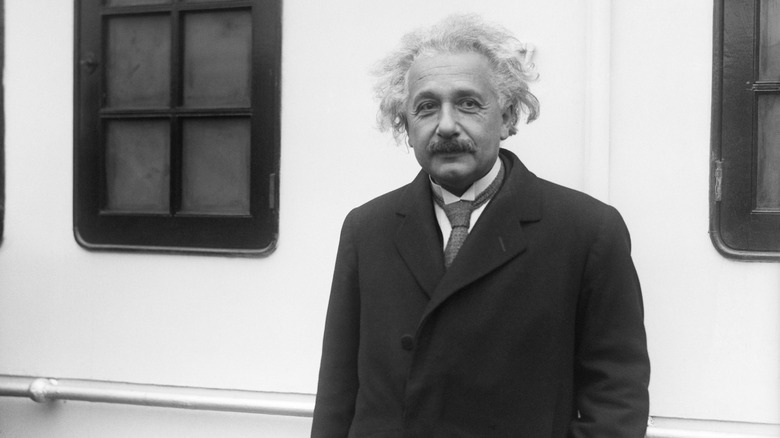

Reverse: My favorite Oppenheimer character was born

On this day in 1879, world-renowned egghead — and part-time New Jersey resident — Albert Einstein was born in Ulm Germany. Here's more from History.com:

Einstein's theories of special and general relativity drastically altered human understanding of the universe, and his work in particle and energy theory helped make possible quantum mechanics and, ultimately, the atomic bomb.

[...]

Although the public was not quick to embrace his revolutionary science, Einstein was welcomed into the circle of Europe's most eminent physicists and given professorships in Zurich, Prague and Berlin. In 1916, he published "The Foundation of the General Theory of Relativity," which proposed that gravity, as well as motion, can affect the intervals of time and of space. According to Einstein, gravitation is not a force, as Isaac Newton had argued, but a curved field in the space-time continuum, created by the presence of mass. An object of very large gravitational mass, such as the sun, would therefore appear to warp space and time around it, which could be demonstrated by observing starlight as it skirted the sun on its way to earth. In 1919, astronomers studying a solar eclipse verified predictions Einstein made in the general theory of relativity, and he became an overnight celebrity. Later, other predictions of general relativity, such as a shift in the orbit of the planet Mercury and the probable existence of black holes, were confirmed by scientists.